Solana (soul)

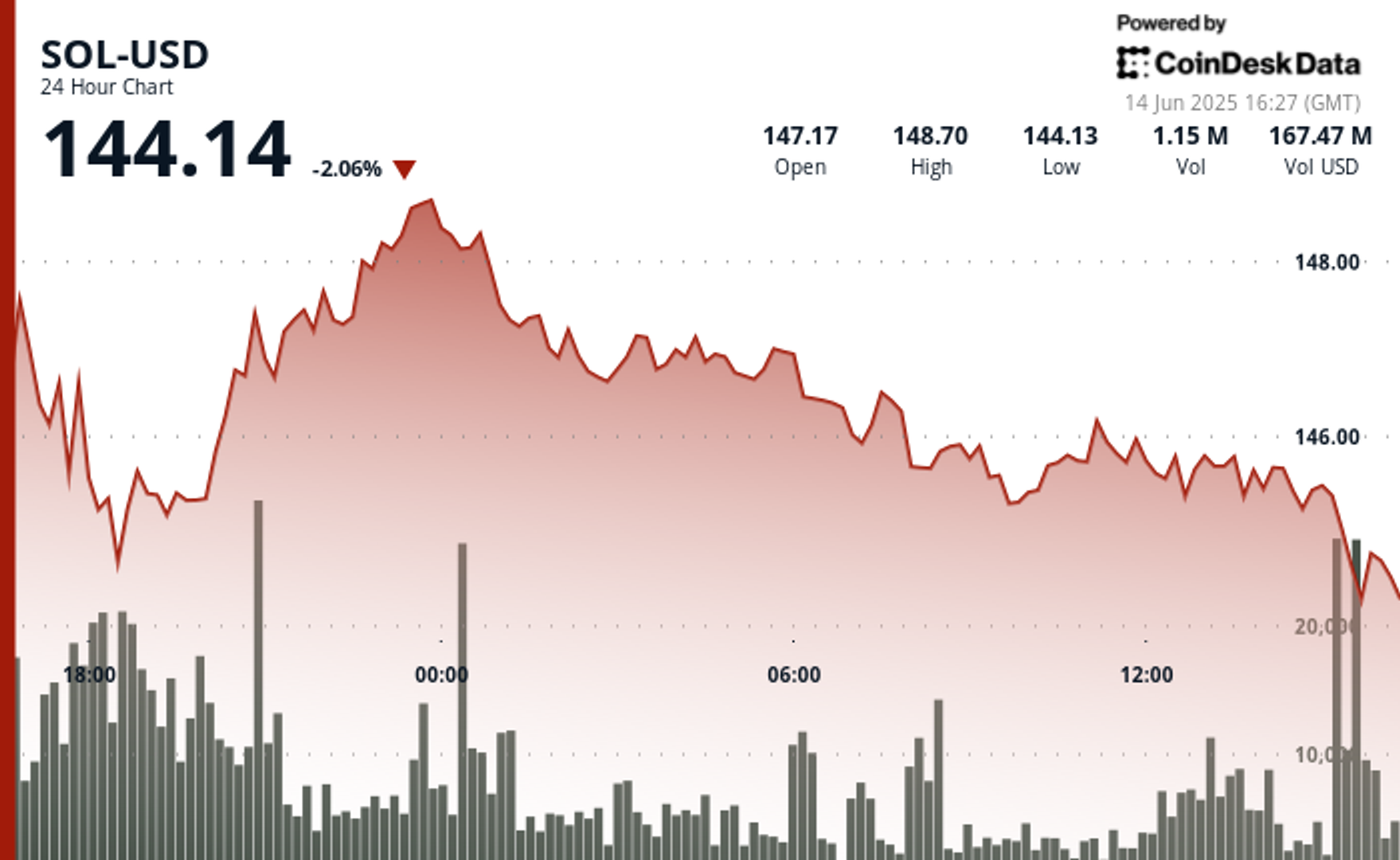

Trade at $ 144.14 on 14 June, showing flexibility as a long-term institutional activity in the last 24 hours, which offtates retail-driven weakness. After extensive multi-day reforms in crypto markets tied to growing geopolitical stress, the price action remains near the lower end of its recent $ 145-$ 149 consolidation.

Despite the recent weakness, two major institutional development Solana suggests deepening the association with the ecosystem.

First, Bloomberg’s James Safart Confirmed On Friday that all seven spots of Salana ETF issuer -IE that includes Fidelity, Grassscale, Vanc, 21Shares, Franklin, Bitwaiz and Canary Marynade, which is S -1 filing updated S -1 filing with SEC. Each filing now includes stacking provisions, making them structurally aligned with Solna’s on-chant economics.

Second, Defef Development Corp, a Nasdaq-list Treasury Firm, Announced On Thursday, it entered the $ 5 billion Equity Line of Credit (ELOC) agreement with RK Capital. This feature allows DEFI Dev Corp to gradually issue shares to fund additional sole accumulation rather than relying on a single, fixed-value offer.

This follows a minor regulator shock: on Wednesday, the company Applied For SEC for return of registration details on Form S-3. It said that it wanted to withdraw a pre -S -3 filing due to the flagcked technical eligibility issues by SEC. The firm said that it would record a resale registration statement in the future that its requirement will increase the capital.

Despite the filing hiccups, the company emphasized its constant commitment to increase its sol treasury, which currently exceeds 609,190 tokens – priced more than $ 97 million. CEO Joseph Onoreti said in Thursday’s press release that the new capital structure provides a “clean, strategic path” to score the exposure while compounding the verification yield.

The price of Sol is stabilizing because these institutional tailwinds are strengthened, even retail activity remains under control.

Technical analysis highlights

- Sol traded from $ 144.13 to $ 148.70 in a 24-hour range of $ 4.57 (3.08%).

- The initial strength faded, the price flows towards the $ 144 support level.

- Resistance remains a firm near $ 149, while short -term rejection hit $ 145.78.

- High-vantage sales occurred between 13: 41–13: 47 UTC, with a sharp fall by $ 145.95.

- 13:23 A volume spike on UTC was aligned with unsuccessful breakout.

- The accumulation of the whale continues below $ 146, although the follow-three is limited.

Disclaimer: Some parts of this article were generated with assistance from the AI tool and reviewed by our editorial team to ensure accuracy and adherence. Our standard. See for more information Coindesk’s full AI policy.