Cryptocurrency on Monday ranked on Monday after a rocky start for the trading session, showing widespread recovery in risky assets as traders digest the downgrade of Moody’s US government bonds.

Bitcoin

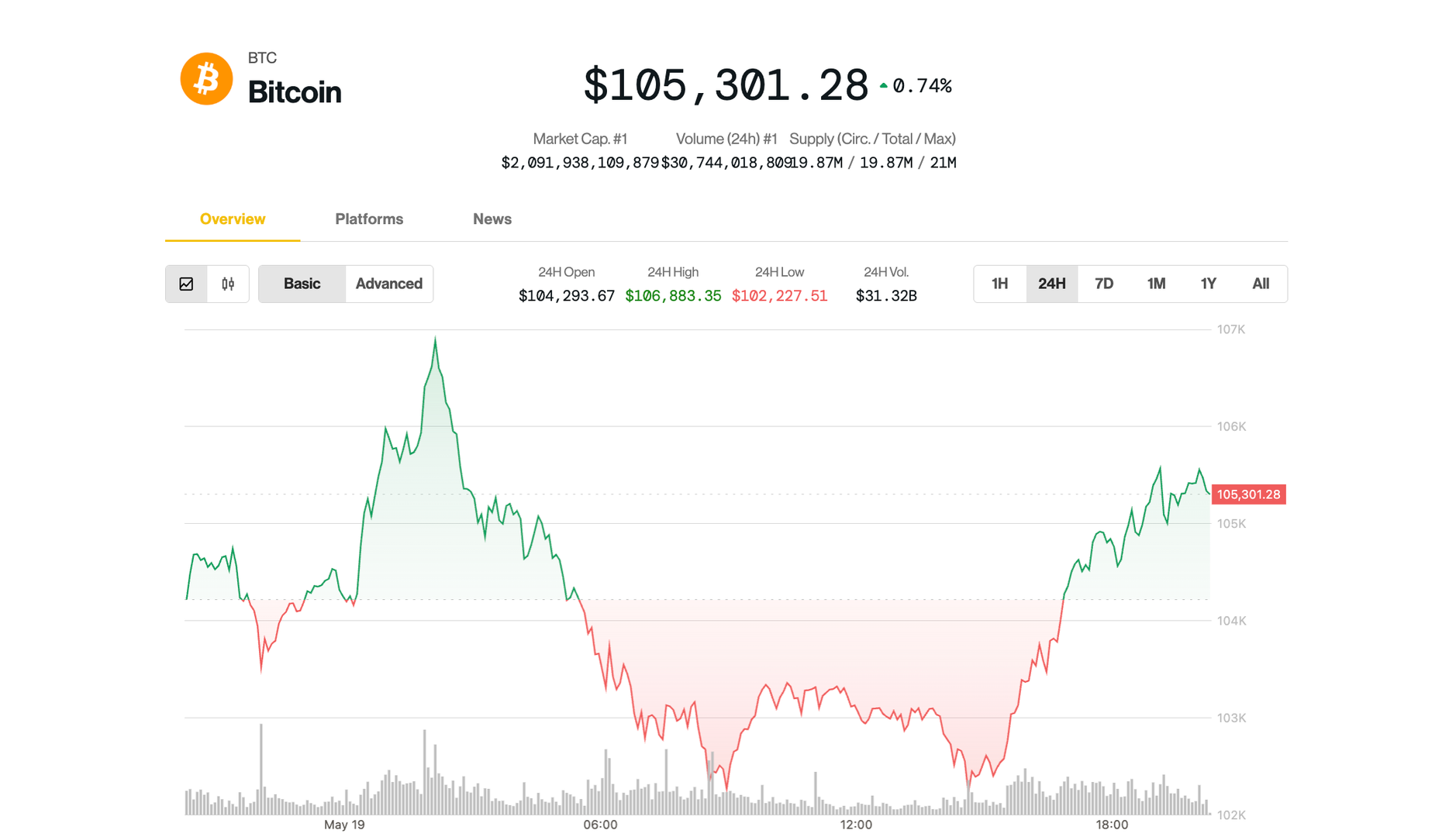

In the US session, after a minimum of $ 102,000, a strong rebound was touched, its records weekly close to $ 106,600 overnight. The largest cryptocurrency by market cap rose to $ 105,000 in the afternoon trading, which was 0.4% in 24 hours. Receiving the level of $ 2,500, the ether increased by 1.2%.

Defi lending platform ave

Most of the larger-cap altcoins improved, while most of the members of the broad-Market Coindsk 20 index still remained in red despite moving from their daily climb. Solana, avalanche and polkadot were 2%-3%below.

The boom also expanded to American shares, S&P 500 and Nasdaq erased their morning fall.

The initial pullback in Crypto and Stock came after Moody’s late Friday night, which downed the US credit rating from its AAA position. The move accelerated the bond markets, to the 30 -year Treasury yield above 5% and the 10 -year note to more than 4.5%.

Nevertheless, some analysts reduced the long -term impact of downgrade on property prices.

Ram Ahluwalia, CEO of Wealth Management firm Lumida Wealth, said, “What is meant for markets (downgrade)? There is nothing in the long term-existing.” He said that unbalanced to large institutional investors in the short term may cause some sales pressure focused on the American treasury, as some of them are mandatory to keep assets only in the AAA-rated securities.

“Moody’s is the last of three major rating agencies to reduce American debt. This was the opposite of a surprise -” was a long time, “said Cali Cox, main market strategist at Ritholtz Wealth Management. “This is why stock investors do not care.”

This year Bitcoin targets $ 138k

While BTC hovers just below its January record prices, the digital asset ETF issuer 21shares looks more upside down for this year.

“Bitcoin is on the verge of a breakout,” the research strategist Matt Mena has written Monday reportHe argued that the current rally of BTC is driven by retail frenzy, but the confluence of structural forces, including institutional flows, a historical supply deficiency, and improvement in macro conditions that suggest more durable and mature tract for fresh all -time high.

Spot bitcoin ETF has consistently absorbed more BTC, which is compared to daily mining, to tighten the supply, while major institutions, strategies and newcomers Twentyers Twenty One Capital deposit and even states find out strategic stores.

These factors can jointly increase BTC to $ 138,500 this year, Meena estimated, translated to about 35% rally for the largest crypto.