Strategy (MSTR) is pulling some forms of financial alchemy: using bitcoin, historically an unstable property, to make something that looks like stability.

This firm offers $ 2 billion “stretch” favorite stock (STRC) offer a variable 9% dividend and is designed to hover the share price near $ 100.

According to the recent NYDIG report, this offering does not give direct bitcoin exposure to investors, yet it is supported by the soul and property in the structure.

The strategy is $ 71.7 billion in bitcoin and only $ 11 billion in liabilities, giving a place to deliver income to dip the price of crypto, also note the report.

Historically, bitcoin returns at least 3% -4% per year at a stretch of any five years, while the average returns are quite high.

The strategy is betting that it can use this return profile to maintain high payments without touching its crypto stand, essentially changes the praise of long -term bitcoins in menstrual cash flow.

“Strc looks like a high-appearance, bitcoin-supported, money-market-style vehicle, designed to trade near $ 100 equal, offering far more yield than traditional short-term devices, with a separate liquidity profile,” Nydig wrote.

This base has proved popular. Investor interest strategized to quadruple the size of $ 500 million to $ 2 billion.

STRC can not only be a yield vehicle, but also re -works for bitcoin, traditional finance income investors. A type of money-market fund, remixed with crypto under the hood.

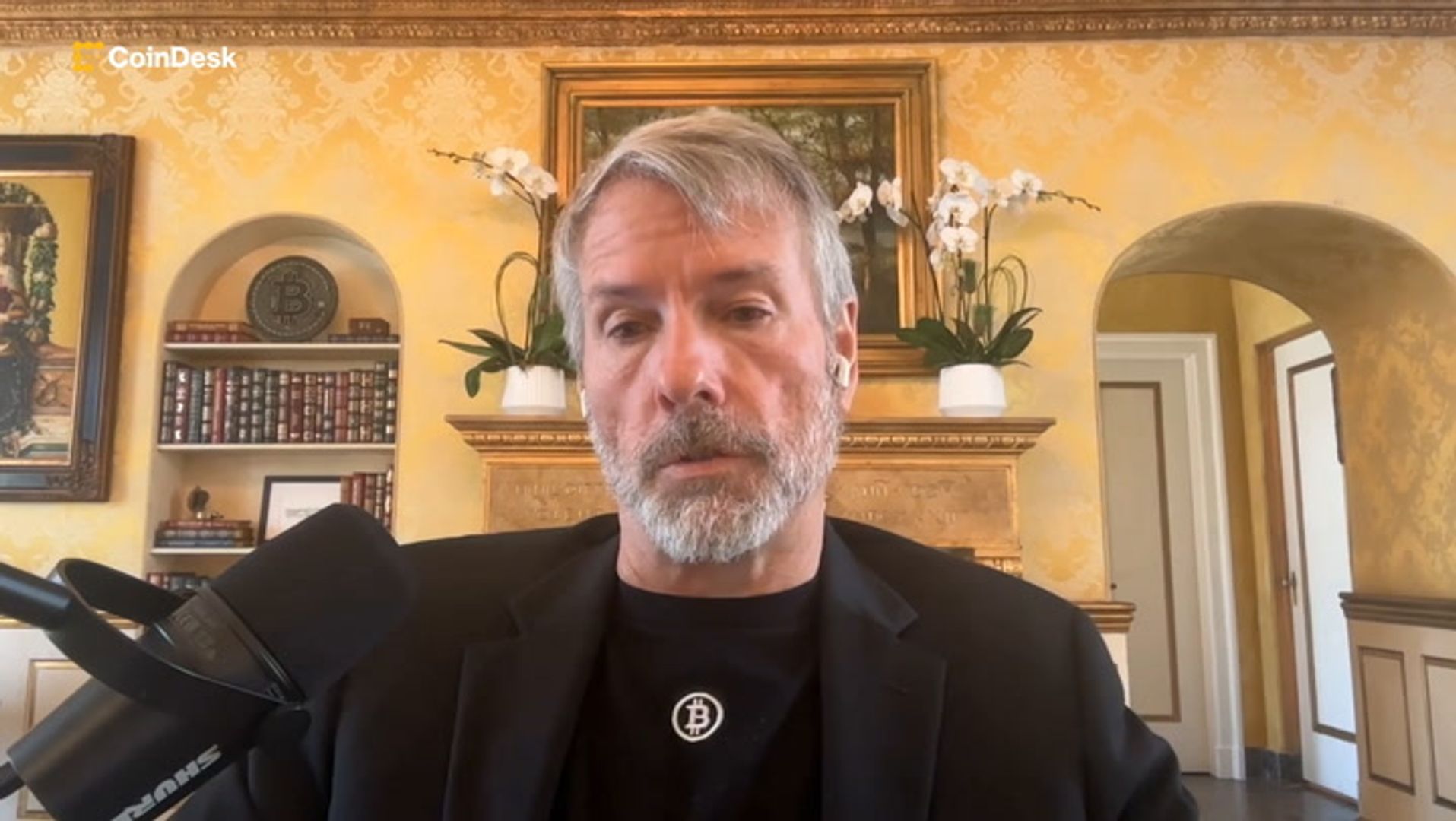

Read more: Michael Sure built his own yield curve with an innocent favorite stock sales