This is a segment from the forward guidance newsletter. To read full versions, subscribe.

At this point it is clear that one of the primary goals of the Trump administration is to reduce trade deficit with other countries, especially goods trade deficit.

It is important to make that distinction, because in fact, America runs a service Excess!

The US imports “goods” from other countries that make it both better and cheaper. And as the world’s reserved currency, US dollars flow in those other countries to fund those purchases.

Those foreign dollars are then reinforced and kept in US-community property such as Treasury and American Equities. This mechanical demand has created an artificially strong US dollar for several decades, paired with a hollowness of the US middle class, whose manufacturing jobs have been discontinued.

Effectively, the grand tradeoffs in globalism reaching the cheap “goods”, but once-a hollow-out of the construction base.

(Economic) One of the great laws of nature is the balance of payment balance. Mechanically, the lack of that currency account (the goods) should be offered by a capital account surplus (money to pay for the goods coming in it).

This structural capital account surplus which has been held for many years, resulting in a structural bid for American property. This has been motivated for mechanically-less treasury yields (low borrowing costs for the government) and high multiples on American equity relative to other countries (much more p than E in a specific P/e ratio).

The Trump administration has been loud and clear that it wants to reduce the current account deficit. Although it does not speak this second part loudly, it comes with a low capital account surplus that will reverse the trend of low bond yields and high equity qualities. Effectively, the Trump administration is asking foreigners to take their money and bring it home.

Foreigners are not wasting at any time to work. This chart of Brent Donley shows how all the action in selling the property of those American-sects is taking place during those abroad market sessions. During the NY session, the US dollar performs stable. However, during Europe and Asia sessions, it is a race for exit.

It is rational for foreign asset managers to get out of these assets if the ripe capital account premium in American assets is being questioned. This will lead to high bond yields and low equity prices.

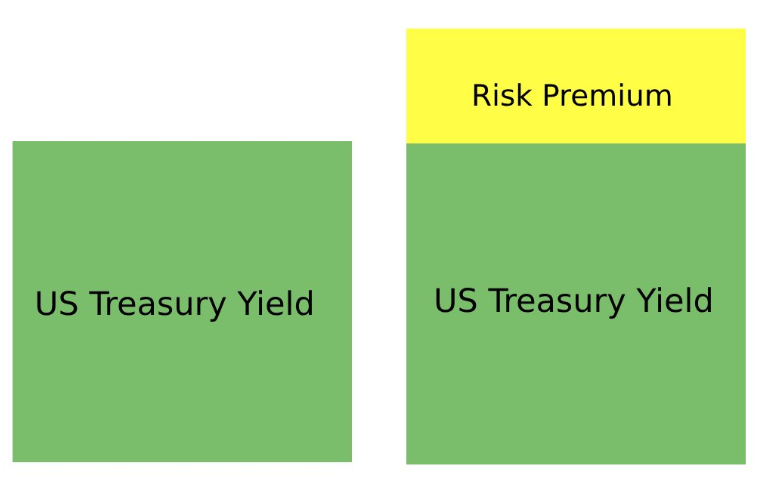

Effectively, the world needs to resume American Treasury yield that is accompanied by a risk premium based on almost all global relative evaluation. My terrible attempt in Photoshop (I am a businessman, not a designer, okay?) This mechanic shows this mechanic below:

It remains to be seen how durable it will be about the current account deficit, but by all accounts, one thing that means: exit American-communized assets.

The President of the United States is originally telling you.

Get news in your inbox. Explore blockwork newsletters: