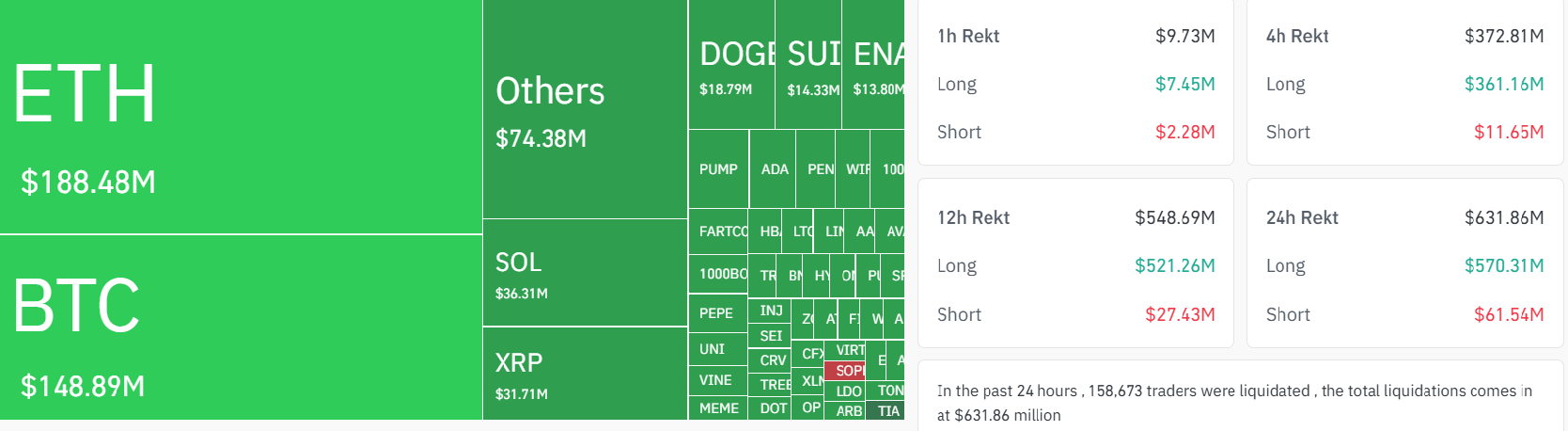

Crypto Markets experienced a sharp boxing of volatility in the last 24 hours, with more than $ 630 million in liverized positions in exchanges.

The damage came from the wholesale longs, with more than $ 580 million of total liquidity, as traders were suddenly discontinued during an intraday cell-off.

Bitcoin (BTC) fell to $ 115,200, erasing some of its recent benefits, but still maintained a relatively stable currency compared to other big companies. Its dominance increased slightly as Altcoins bored the brunt of improvement.

Ether (Eth) fell to $ 3,687, while XRP (XRP) retreated under $ 3 despite strong recent headlines. Solana (Sol) pulled back to $ 170, and BNB (BNB) decreased by $ 780 after running a record last week, which raised it above $ 855.

Coinglass data shows that the largest single liquidation was $ 13.7 million eth tall on binance.

The liquidation occurs when traders used leverages (borrowed funds), forcibly stopping from their positions because their collateral essential maintenance falls below the threshold. This usually increases value volatility, especially in a short deadline, because the liquid position makes a sudden sale or purchase pressure based on the side of the business.

For traders, the liquidation data provides insight into the risk of the market and the risk of the status. High liquidation yoga – especially concentrated in a direction (eg, longs) – often signal oversexed positioning. This market may indicate potentially divine points or adjacent upsurge in the form of reset.

A monitoring of real-time liquidity heatmaps and funding rates can help traders to identify forcibly sale or purchase areas, often exit during major support/resistance levels, time entries, time entries or high-volatility zones and gauge market oulenge and risk-trans-on behavior.

The speculative altcunes were particularly affected. Solana-ocosystem tokens such as fartcoin (fart), pump. Fun (pump) and Jupiter (JP) all faced standing intraday reforms.

Bitgate chief analyst Ryan Lee said, “We see tokens like fartcoins and pumps.

“Recently reforms-Farts to leave 14% to retract their 100-day EMA near $ 1, Jupe lost support in its 200-day EMA, and the pump continues to continue its slide within a descending channel-the stems appear to take over and reduce short-term speeds, not from a systemic market change.

Lee said that the relative power of the bitcoin supported by ETF inflow and macroeconomic stability, reinforces the approach that the pullback is isolated, not widespread-based.

Over $ 115,000, the bitcoin holding market remains anchor. The comprehensive structure remains intact until that level is broken.