Bitcoin

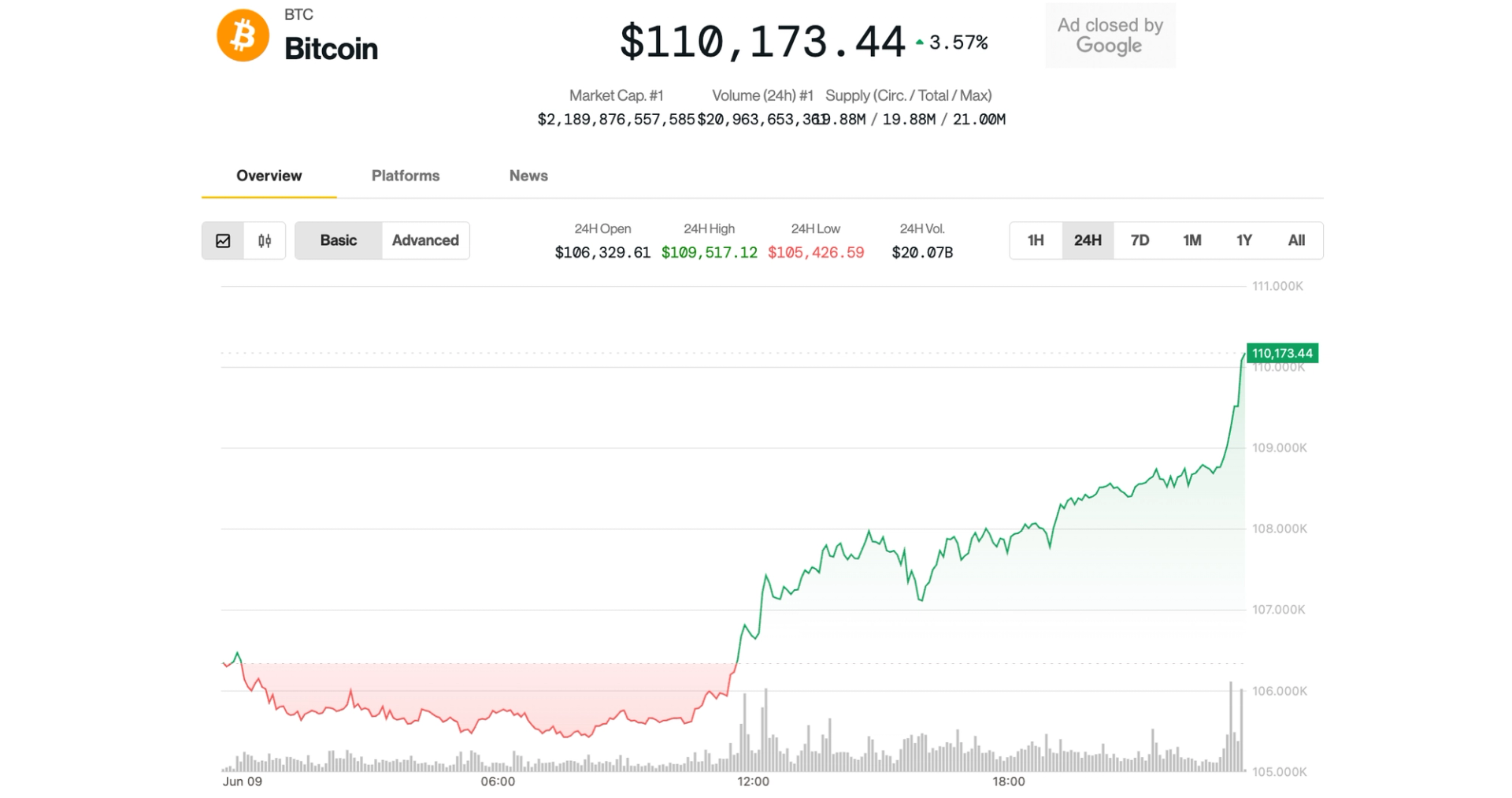

The quiet climb on Monday accelerated its strongest price in June, rebounding from the fall of last week to the fall near all high levels.

The largest crypto in the last 24 hours has upgraded to 3.7%, top of $ 110,000, and it is changing hands with only 2% of its record prices seen in May. Etherium ether

During the same period, there was a synergy with 3.8% profit, jumped above $ 2,620. Original token of hyperlicid And SUI improved most large-cap cryptocurrency to grow 7% and 4.5% respectively.

Bitcoin moves highly caught traders off-guards, more than small posts worth more than $ 110 million within an hour, Coing Class, Coinglass data Show. Across all crypto assets, some $ 330 million shorts during the day, most a month. Shorts are demanding profit from the fall in property prices.

The move occurred when traditional markets showed muted action, with S&P 500 and Nasdaq index flat. Crypto-related stocks jumped during the session to catch BTC recovery over the weekends.

“A ‘peaceful rally” is a perfect way to describe this price action, “said the founder of Cubic Analytics well analyst Kaleb Franzen. “Just a consistent development of high high and high climb. Any signs of weakness? Buyers step into the trend and defend.”

The Crypto market is now stable for a potential next leg after the fall of bitcoin 10% and in the previous week, with more than $ 1.9 billion in liquidity in crypto derivatives, a Monday report has highlighted the excessive emergence by bitfinex analysts in a Monday report.

However, the on-chant data indicates the long-term holders’ growing sales pressure that can overwhelm the demand, the analysts said.

“Bitcoin is now at an intersection – between the structural support and reducing the speed of rapid pace, its next macro is waiting,” said the bitfinex note.

Those macro catalysts may come at the end of this week, said OTC trader Jake O in the Crypto Trading Firm Vintermoot.

He said, “The US and Chinese trade representatives have been set to complete today, after the positive speed of the previous week, the markets are likely to be sensitive to any headlines, and the data calendar remains light till Wednesday, when CPI will provide new insight into US inflation,” he said.

Update (June 9, 21:51 UTC): Small liquidation adds data from coinglass.