The market turned red on Friday on new tariff-related apprehensions.

Bitcoin

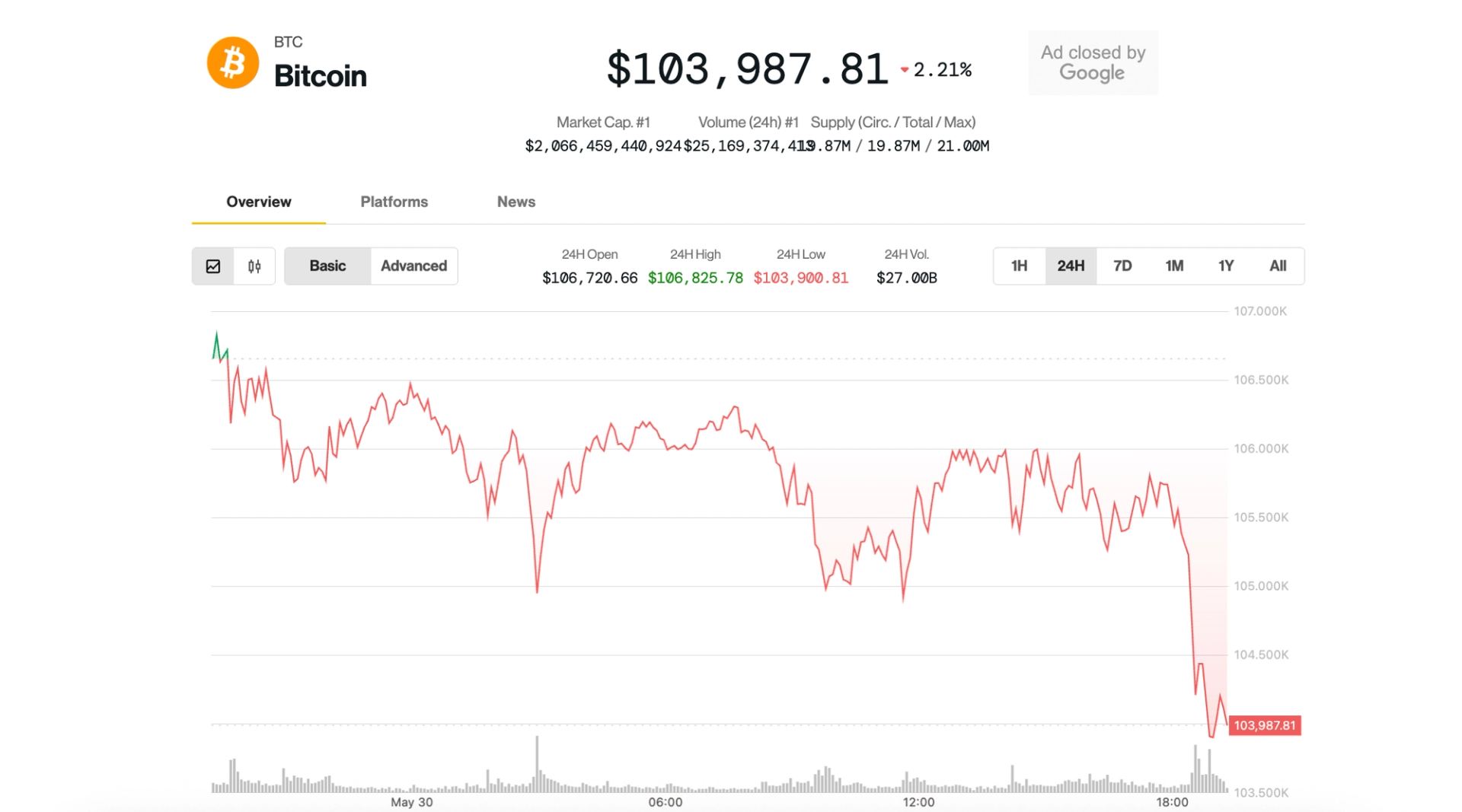

The last 24 hours is 2.1% below, after trading more than $ 104,000, the $ 103,900 session is low. Coindesk 20 – An index of top 20 cryptocurrency by market capitalization, stablecoins, memecoins and except exchanges coins – slipped to 4.2%, even further.

Smart contract platforms were particularly affected, with Solan

Needle and avalanche are losing 6.3%, 7.8% and 7.3% respectively.

Crypto Stock also took a hit, especially the bitcoin mining firm Bitdier (BTDR), 8.3% a day after a run-up, which saw a 132% increase in the stock from 16 April to 21 May. Strategy (MSTR) 2.7%, and coinbase (coin) 1.3% slide.

The bleeding was not contained in the crypto. S&P 500 and NASDAQ are 1% and 1.5% below, while gold is 0.7% lost.

US-China Tariff Clash: Round 2?

The price behind the price action was once again to incite American trade tension after an agreement earlier this month. Concerns came after President Donald Trump accused In China Post Socially to “violate” tariffs between countries on truth.

Meanwhile, Treasury Secretary Scott Besent said in the Fox News interview that the conversation with Chinese representatives was “stopped”.

China, in response, urged the US to “fix its wrongdoing immediately, stop discriminatory sanctions,” BBC Informed

The cool-off between the US and China helped the Risk Property Rally in May, providing a tailwind to bring a new record to BTC to a higher level. Re -growth now threatens to open some of those benefits.

Read more: Bitcoin whale is calling a top as BTC price consolidated