This is a segment from the supply shock newsletter. To read full versions, subscribe.

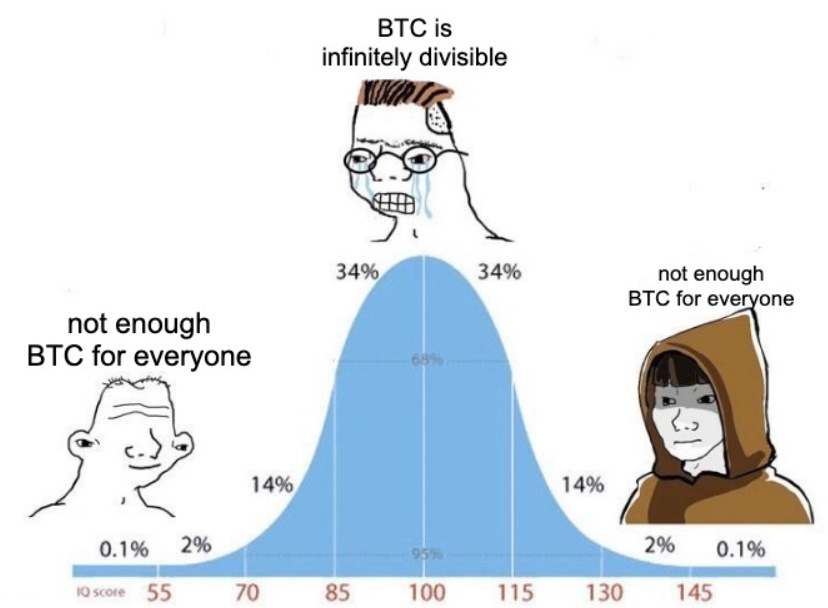

Bitcoin in $ 120,000 is a win for all on the left and right edges of the notorious Bell curve meme.

Middle-ghumav is almost never an optimal strategy. Except, perhaps, a very specific point in a cycle – especially in the deep bear markets, when vibes and narratives are less powerful.

Right now, both the extreme ends of the bell curve are shouting one thing: not enough bitcoin for all.

For example, the left over the deficiency of bitcoin happens in this way:

Bitcoin is currently programmed to release only 21 million BTCs. Most of this time has already been mined.

In fact, mining income is now a small decline in the bucket compared to the trading activity in the coinbase, which is equal to less than 1% of their combined daily volume.

Now reduce the coins that are believed to have been lost – until one estimated About 20%of 4 million coins, or the entire desired supply.

We are currently leaving with 15.9 million BTC. At the same time, there are more than USD 58 million Millionaire Worldwide. It puts a millionaire-to-bitcoin ratio on 3.6-to-1.

If you feel that smart money (millionaire) would like to buy bitcoins with rapid time – in size – then only one way is to be a price. Above. This is simple supply and demand.

Orange Line (BTC/USD) has never been overflowing, unlike gold line (gold ratio of bitcoin),

Middle-sector will explain that bitcoin is divisible by eight decimal places. So when the whole bitcoin is rare, the personal satosh is clearly anything but.

For the sake of cleanliness, we would say that the current circulating supply of the set is lost forever, is 1,590,000,000,000,000. It is a quadrilian, five hundred ninety trillion sets – 190,000x larger than the total human population.

Therefore, a single distribution of current set supply to each person on Earth will be equal to 190,000 sets.

A general refutation for this argument historically has been suitable about pizza. Imagine that you have a delicious cheese pizza, and you need to feed a village with it. Except that it is nowhere.

Does cutting it in small slices help it? Of course, you are left with equal amounts of pizza. 1 pizza = 1 pizza; 1 BTC = 1 BTC.

A rare event: BTC dominance is being accompanied by its market cap. Usually they are oppositely correlated.

Apparently, the pizza ribetal has a defect: imagine that each of those small slices can develop into a huge pizza, such as adding water into one of the toys that expand when wet rapidly. Suddenly, the entire village can be easily fed, and perhaps also neighboring villages.

With this lines, the consensus is making that bitcoin is in luck to reach $ 1 million per coin. Bloomberg terminal just began Sect BTC (current value: $ 0.122 million) in millions.

Now take it to the peak.

If hyperbitcinization actually occurs and is worth bitcoin, it is said, $ 500 million epinage, then each satoshi will be equal to about $ 5. At that time, perhaps we will be surprised at the cost of a personal set instead of the entire bitcoin.

And in addition, it is technically possible that it is possible to add even more decimal points in bitcoin, somewhere under the line, where the whole coins are impossible. Lightning even tracks the so -called “MilliSatochesis”, which is 1/1000 of a set.

But remember, this is not the time of mid-pool. If you fancy yourself on the right side of the curve, the emotion is exactly the same to the left: not enough BTC for all, as proved by the high levels of its recent time.

This is simple supply and demand.

Get news in your inbox. Explore blockwork newsletters: