This is a segment from the forward guidance newsletter. To read full versions, subscribe.

As you have probably heard a thousand times: tokening is in its early stages.

But a new tidbit confirms that the utility of onchain assets will continue to develop.

As it now stands, Stabelines are “actually the only (RWA)”, who has received enough product-market fit, Ondo Finance CEO Nathan Allman recently told me. (My Fuller Q&A Hit with Allman Blockworks.co A little later).

Earlier this month was the IPO of the circle and the Senate passed the Genius Act last night, both of them further brought Stabecines to the public eye.

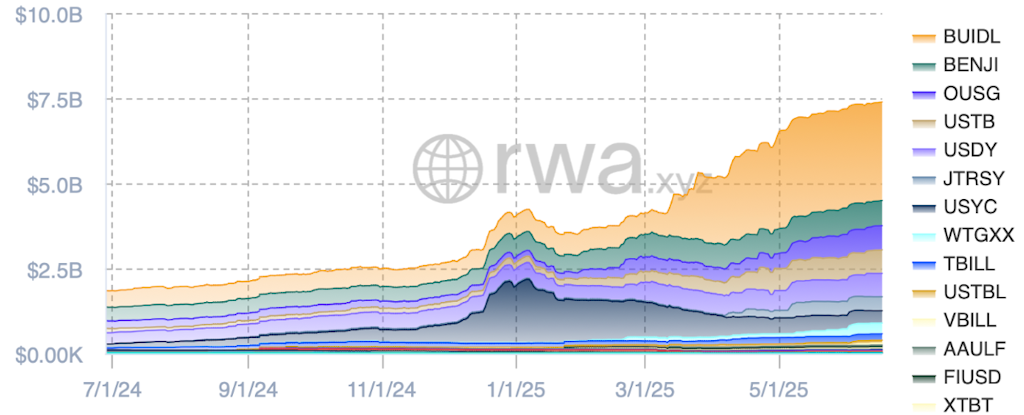

While the promise of more comprehensive access to token stocks, bonds and other assets has not yet been fully felt, there is money market fund with growing traction with another token RWA.

In March 2024, Blackrock joined the game through USD Institutional Digital Liquidity Fund (BUIDL) launch. Its assets under management are around $ 2.9 billion.

Now, some institutional customers using crypto.com and Deribit can post Buidl as collateral. The idea is enabling the capital allocation flexibility, attaining the relative value stability of the token treasury.

And yield.

As CEO Carlos Domingo placed it in a statement: “Fund is developing into a main component of the basic structure of the Crypto market from a produce-bearing token.”

Token Money Market Fund ~ $ 240 billion is not here to replace the Stabecin Market, the industry has noticed.

Waqar Chaudri of Standard Chartered told me in March that the two are “certainly complementary,” by: “Many people may prefer token funds for collateral management.”

But when Robbie Michanik of Blackrock saw the token a yield fund of tokens as a major cash savings vehicle, he believes that Stabelin “will” maintain his dominance for payment and transaction “. About $ 1.2 trillion of the derabit in the trading volume was a reason that the coinbase assured to buy the company last month.

We will see if development contributes to adopting the yield funds made today and how quick token. And, of course, we will come back to you.

Get news in your inbox. Explore blockwork newsletters: