Yesterday, July 30, the launch of Atherium was a 10 -year anniversary. In today’s crypto for advisory newspapers, Alec bakeman Treasury writes as a reserve asset about the growing role of ether from Psalion and highlights the growing trends.

Then, Eric Tomasevsky Varde answers questions about ether as an investment in a specialist from Capital Management.

Thanks to our sponsor of this week’s newspaper, Grassscale. For financial advisors: Register for the upcoming Miniapolis event on 18 September.

– Sara Morton

Etherium: Rising Treasury Asset Rapping Corporate Finance

Ether, the cryptocurrency of etherium blockchain, is being adopted by public companies as a strategic treasury asset, a development that is helping to recreate corporate finance and transfer the dynamics of the ETH market.

Bitcoin dominates for a long time Digital treasury conversationIts capped supply and decentralized nature make it a defense against inflation and a reserves of value. Ether is holding, thanks to its yield capacity, economics, real -world utility and institutional infrastructure.

Why the Etherium appeals to the treasure

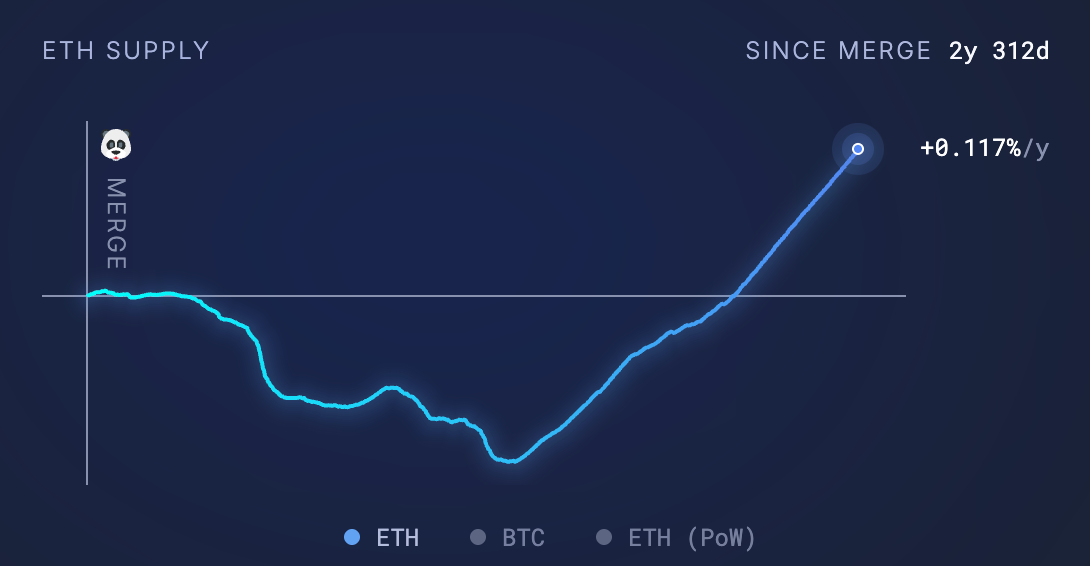

Atherium’s 2022 Infection for evidence The holders were enabled to earn annual stacking yields between 2% and 4%, building a passive income layer that does not offer bitcoin. There is also property Defaulter Many times, ETHs were burnt more than the released, supporting a store-off-value thesis.

At the same time, atherium strengthens a decentralized applications, token assets and a ecosystem of smart contracts. For corporations, it can act as capital not only as a reserved property, but also to deploy services and infrastructure.

Ath Treasury Wave

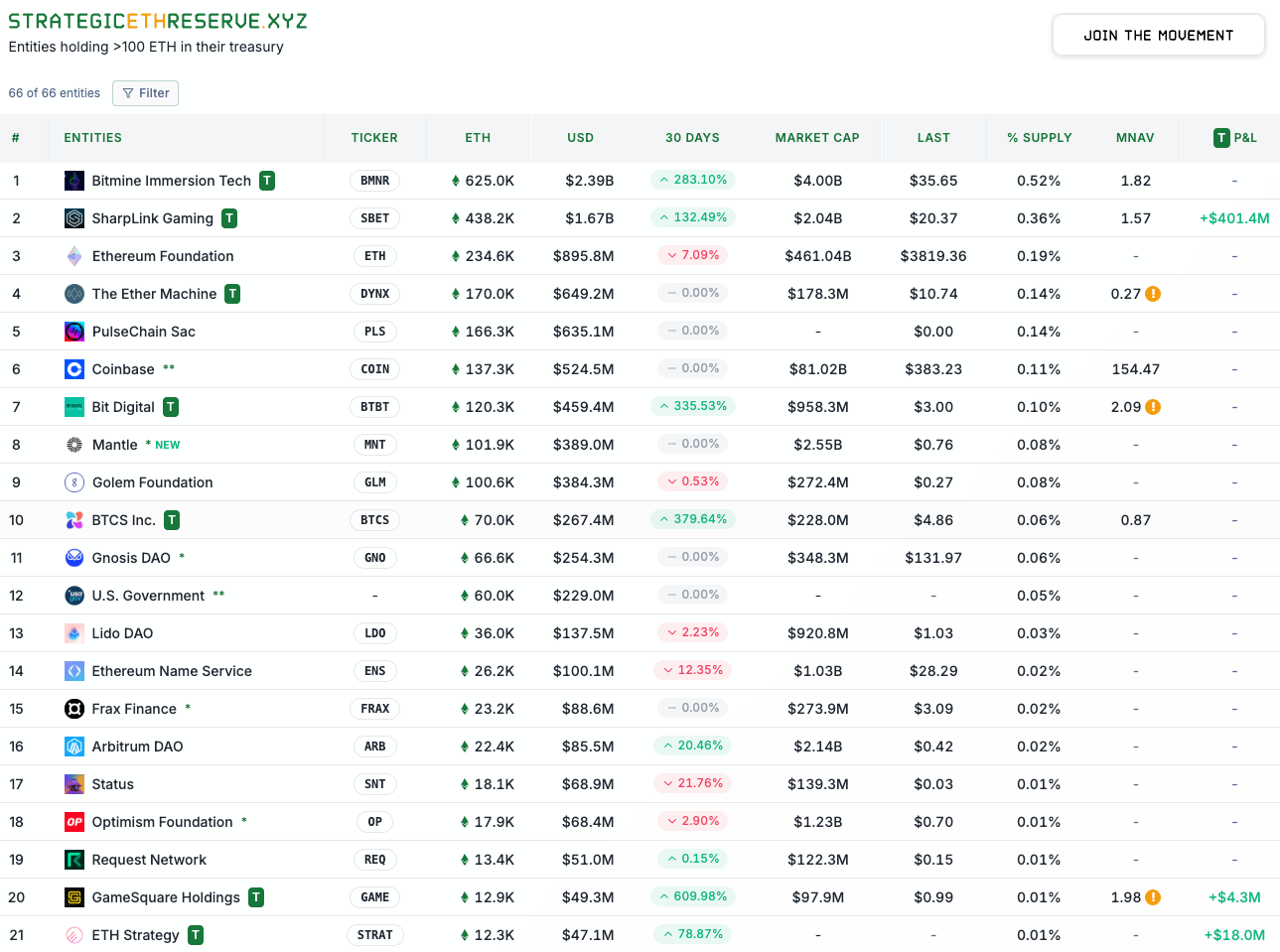

many Public companies are now making treasury strategies Around Eth, follow the early moves like a microstrate in bitcoin:

- Bit digital layer 120,300 ET And suppresses its entire allocation. CEO Sam Tabar calls it a “flywheel model”, where stacking produce fund operation. They Plan to add more > To the tune of $ 1B.

- BTCS Recently, its stake rose to over 70,000 Eth and Eth was one of the first public firms to stake as a treasury strategy.

- Bitmine immersion The target is to acquire 5% of the total ETH supplyUnder the important funding and Tom Lee, it is now more than 625,000 Aths.

- Sharplink gaming Ethh exceeds $ 1.67 billion, adds about 80,000 coins a week and pursues stacking as a main strategy. Joe Lubin is a board member and running his ET acquisition strategy.

- Gamesquare EthH has an initial $ 30 million allocated Approval on a scale of $ 250 millionIt is also planning to integrate the Defi and NFT-based produce as differentials. The gamesquare sees the ethrium network as a manhattan, with a financial district (Defi), an art district (NFTS), and more. Investing in today is important for future value and use.

- Ether machineA SPAC-supported vehicle exits the publicly trading dynamics, setting a target of $ 1.5 billion in Eth as it is ready to go publicly.

Companies have planned to add much more schemes. Other companies have only announced their holdings Ethjilla,

These companies are not just purchasing … they are indicating long -term punishment and in many cases, making products and revenue streams directly on the atherium. An example is a gamecquere, whose strategy is closely aligned with its audience in gaming, media and entertainment industries and looks at the relationship with on-chant products built on the atherium. It is important for them to promote financial alignment with their audience.

BTCS is applying a uniform strategy to align with its audience, as Block building And create a vertical stack on the stacking atherium network, resulting in the ability in transactions and stacking.

Demand

The price of Eth has been continuously climbing in recent months, and public company shopping is one of the primary catalysts for this increase. Over in recent 30-day intervals ETH was purchased 32 times more than issuedThis includes purchasing from Treasury Aloketer, Steaking Vehicles and new approved ETFs. The continuity of this trend will make a supply blow.

Unlike bitcoins, where miners should often sell their bitcoins to cover operating costs, reduce shift-side pressure from the atherium’s proof-of-setk and align the holders with securing the network.

conclusion

Ethereum is no longer a platform for developers; It is now a financial property that public companies are adopting on a scale. With the underlying produce, the dynamics of deflation and the increasing institutional demand, the ETH corporate is emerging as the foundation stone of the treasury strategy. Since more firms go from “interested” to “allocated”, this new wave of ETH buyers can help define the next step of the Crypto cycle.

Special thanks to Bit-Digital CEO Sam Tabar, Charles Alan, BTCS CEO, Justin Kenna, CEO of Gameskware and CEO of Ridan Lee.

, Alec Bakeman, Vice President of Growth, Psalion

Ask a specialist

Question: Why Eth is being discussed as a strategic reserve property?

A: The atherium has quietly become a financial infrastructure, not just a speculative property.

Unlike bitcoins (which is mostly “value stores”), ETH gives power to a real economy that is associated with smart contracts, tokens, stabechoin transactions and decentralized financial services. As more economic activity resides on the atherium, Ath is considered a reserved property by institutions, fintech firms, DAOs and even sovereign actors.

The reason is that Eth is the fuel that works on the system. It is similar to the treasury placing oil in an energy economy or in a dollar system.

Question: Should a corporate treasury be considered a form of ETH a cash counterpart, long-term technical-oriented equity, or an abstract infrastructure?

A: In practice, I see it as a new sleeve in the portfolio that I would call “Digital Infrastructure Reserve”. It carries the tech beta and regulatory risk, but also provides operating utility (smart-contract escrow, settlement, toknarization rail). This is neither cash nor equity.

Question: How do you translate “as a strategic reserve” in practical implications?

A: For institutions and treasures:

- The ETH serves as cash and collateral to run on-chain business.

- It produces a yield (staking) like a tea-bill.

- It is conducted on the balance sheet, declared in treasury policies, and audited.

For individuals and families:

- Eth is considered as a long -term strategic property.

- Writably allocated (at least 1-5%) and separated from short-term needs.

- The staking is used to earn income, hedge against fiat devaluation, and exposure to the growing role of atherium in finance and tokens the infrastructure.

Q: What will prove that ATH should be treated like a serious reserved property in the next 10 years?

A: If more financial activity of the world such as tokens of real estate, stabelcoins, and large international payments are settling directly on the atherium, it reflects the growing confidence in the network. Since the atherium becomes a core infrastructure for global value transfer, ETH runs into a valid strategic reserve from speculation.

Strategicthreserve.xyz is a great source for progress. In addition, it is helpful to see innovation and creativity of names such as Robinhood and Ether machine to keep some names.

, Eric Tomasevsky, Financial Advisor, Verde Capital Management

keep reading

- The White House released its first digital asset policy report on Wednesday, 30 July.

- Billionaire Re Porridge recommended one 15% bitcoin exposure In the portfolio to hedge against Fiat debut.

- Samsung has participated with a coinbase to integrate Crypto payment For Samsung users.