It is a section of the Empire Newsletter. To read full versions, subscribe.

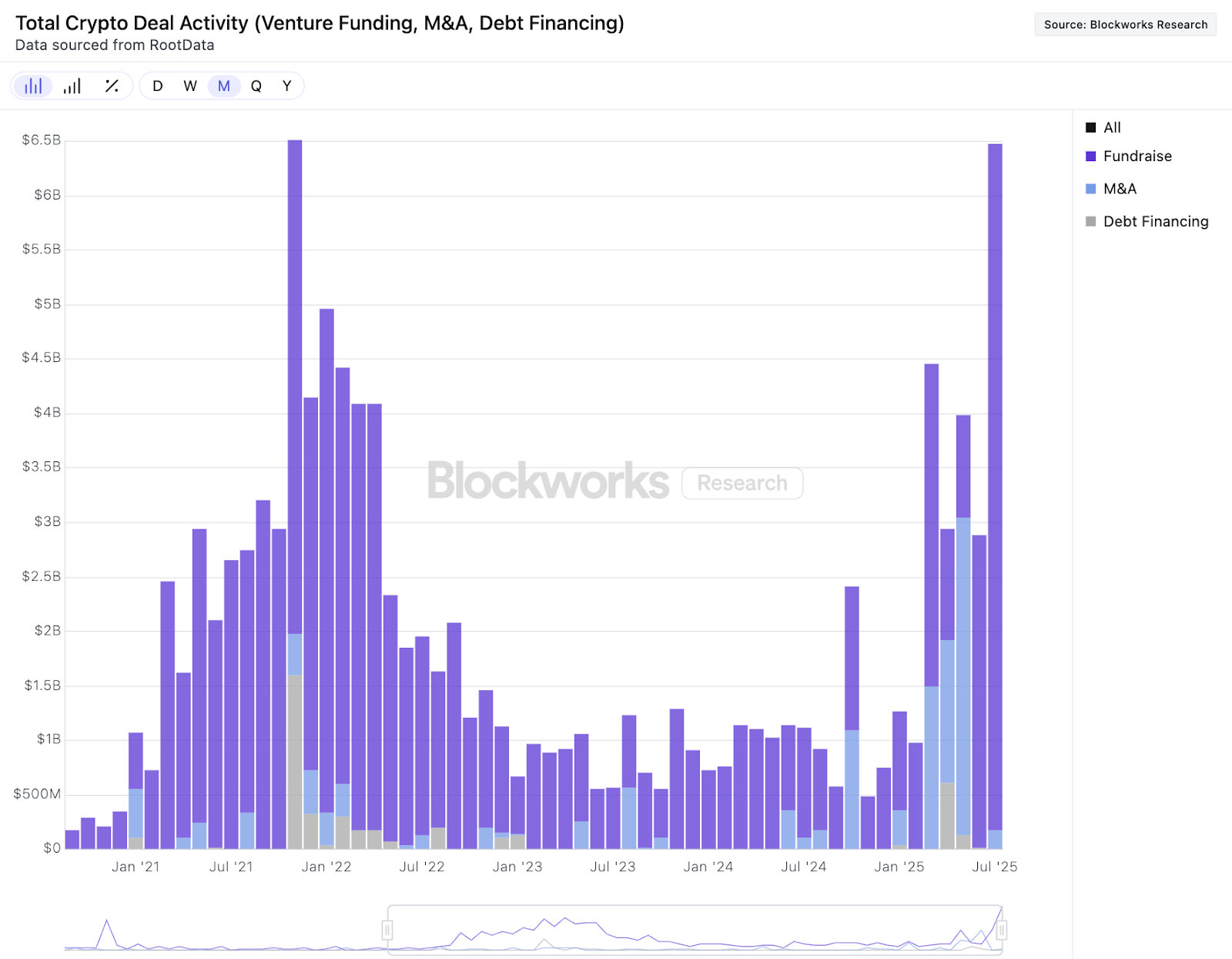

In July, we saw more than $ 6 billion in funding, A Beautiful According to blockworks research data, larger growth compared to June.

See Etty-Bitti June time compared to July

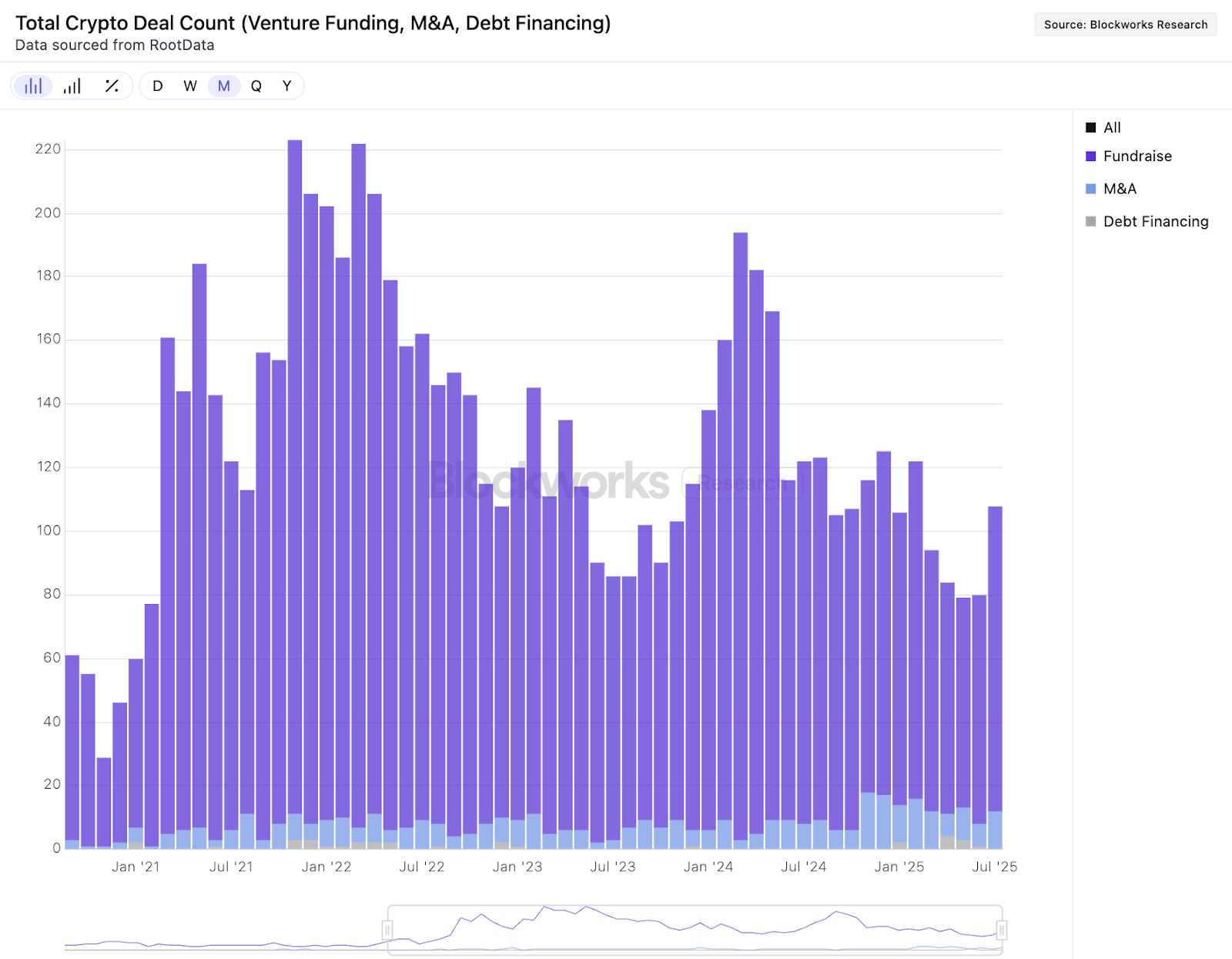

Out of that $ 6 billion, about 177 million dollars came from M&A activity. To break it further: 96 raise announcements were made only compared to 12 M&A announcements. Both June and May saw the announcement of 10 or less M&A, it ever chose so little.

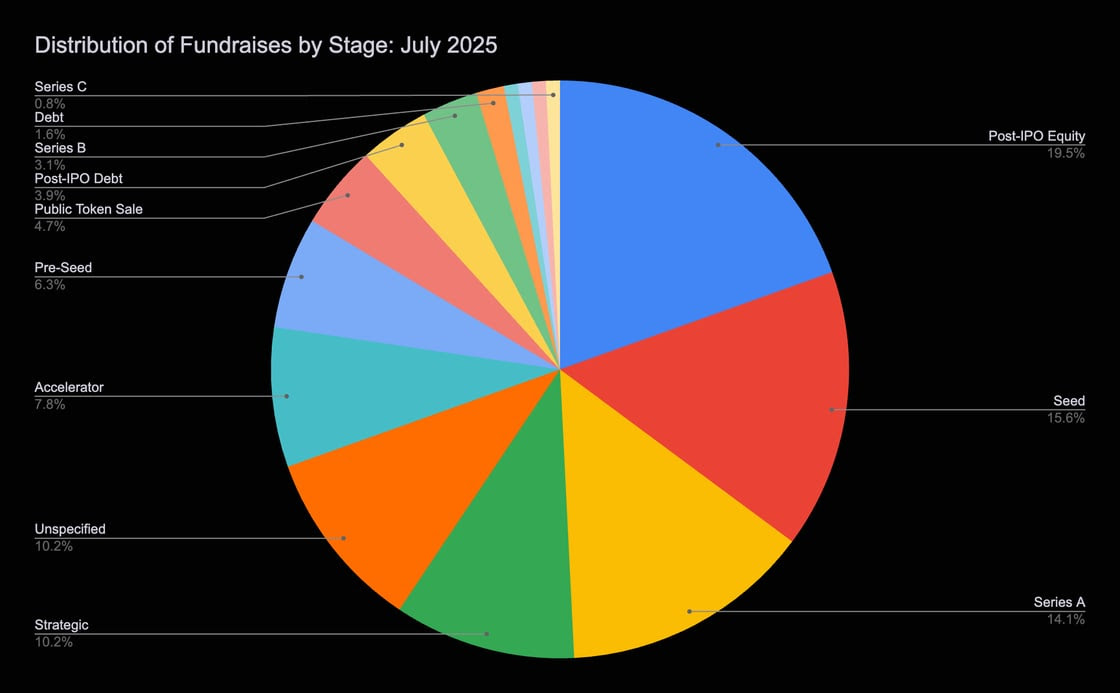

To give you a better idea of breakdown

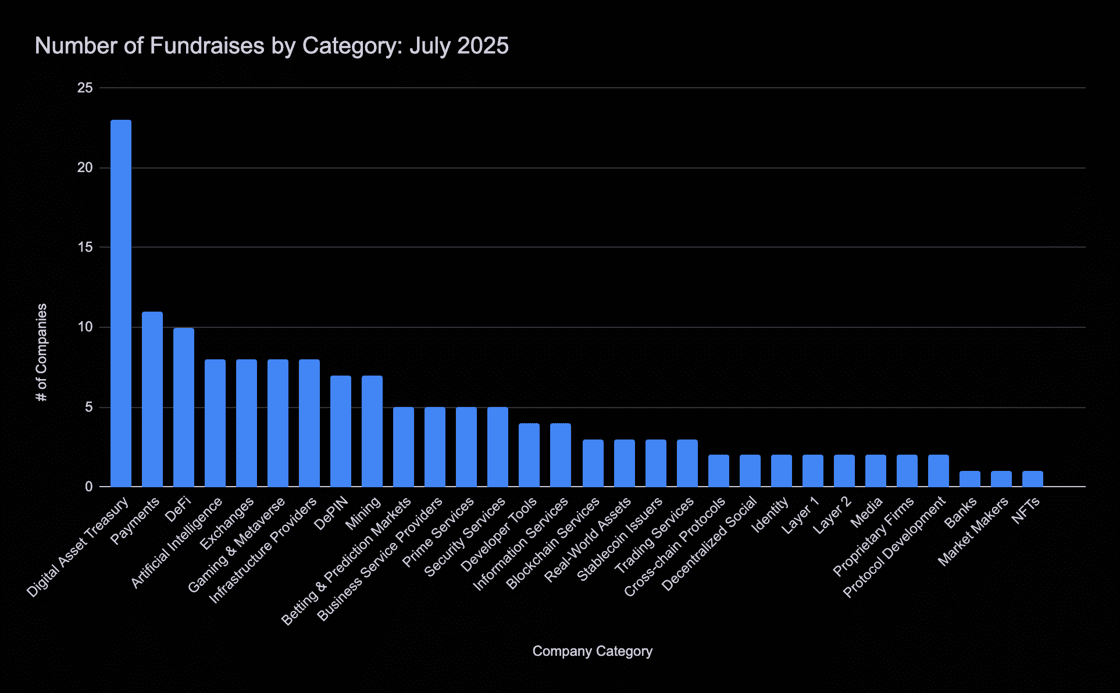

If we look at tie data, including Digital asset treasure The company arises, then we can also assume which stages were the most popular last month.

Source: Tie Terminal

With the rise of digital asset treasury companies, a good amount of equity after IPO has increased. However, except for DATS, most of the increase announcements were either the seed round or series A rounds.

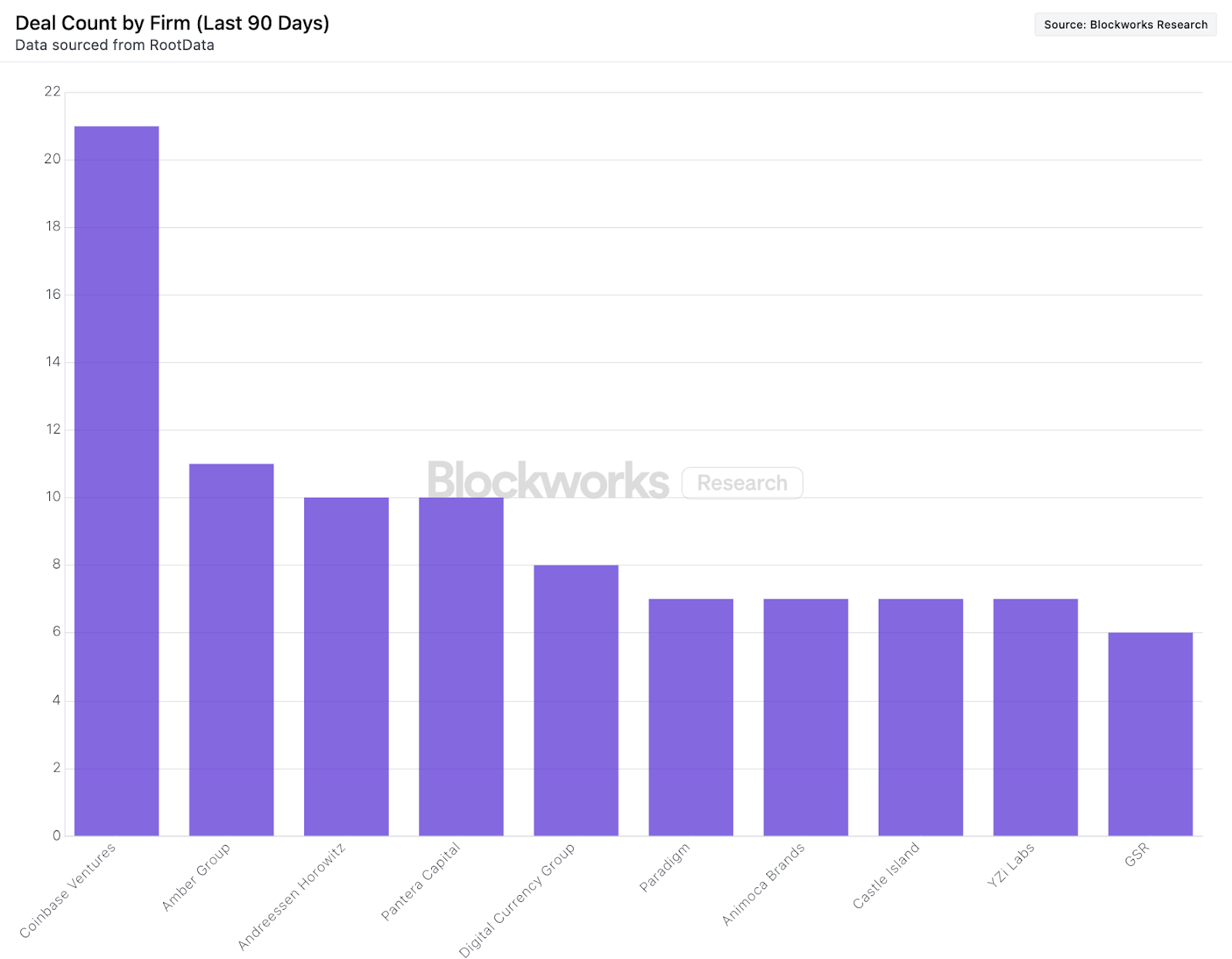

Let’s move forward. Venture takes forward funding: Coinbase Ventures was one of the most active investors in the last month, participating in 21 rounds.

To keep all this in perspective, June returned to funding after another. Very Slow May, and it seems that July is showing another pick up again.

Last month also surpassed March, which was the most successful month since 2021 based on blockworks research data, which goes to show how large the hunger is. Currently, if we are looking, DATS clearly rule the highest. Total Money raising.

Source: Tie Terminal

However, the payment also saw a good activity. As Defee (which was the second most popular category in June for wealth).

Here is my tech: Dats is a hot item of the moment, and it shows in the data. However, I am eager to see if they can continue this speed in August (which, like the summer months, the seasonal becomes weak) or if we will see a slight decline next month.

But overall, the data looks very strong at this point, and we did not really leave how successful Crypto IPOs have been.

Get news in your inbox. Explore blockwork newsletters: