A third Americans (33%) say they cannot even cover the bill for a month if they lose their income, and 47% recently refer to the cost of living as their biggest obstacle to save, according to recent survey From Yahoo Finance and Marist Pol.

Each state’s living wages are at least $ 82,000 per year, and in 26 states, a family of four will have to earn at least $ 100,000 annually, which should be considered “financially safe” – or $ 150,000 if they are in Hawaii, Massachusets, California and New York, according to per Gobanking. data,

Related: People under 25 years of age have the best chance to make money in this American state – and these 2 are the worst among others.

Naturally, many people feel that they do not have much money left after contributing to the required costs and savings accounts.

A new study from online lender Cachetusa Exactly – exactly shows how many disposable incomes have an annual income in every state – and comes with a calculator for you that you determine your own determination and see how it compares.

Related: Youths earning more than $ 200,000 per year are running away from 1 US state – and 2 flocks for others

Use 50/30/20 Budget Calculator here to find out how much you can spend after the post -monthly income of “vs” needs “and” savings “:

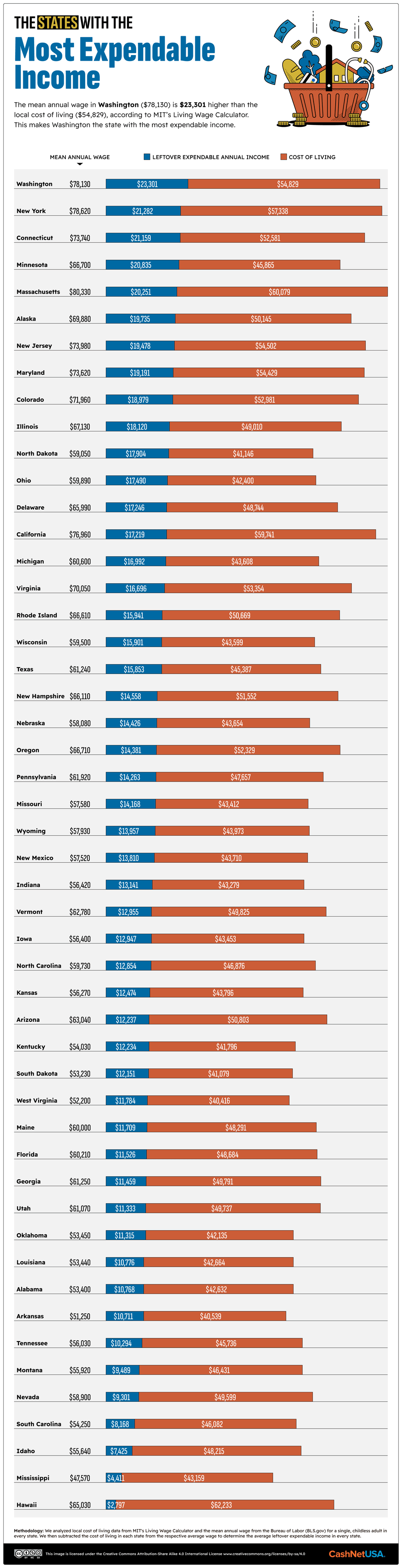

Cashnetusa research, which examined the cost of data living from MIT’s living veg calculator and average wages by the Metropolis from the Labor Statistics Bureau, found that single people in Washington have more disposable income than those in any other state, on average, in any other state: $ 23,301.

Residents of New York, Connecticut, Minnesota and Massachusetts scored a goal to the top five states, where people have the most disposable income each year, with an average from $ 20,251 to $ 21,282, according to data. There was no disposable income in any other states in the ranking, which reached $ 20,000 or increased.

Related: These are the states where $ 1 million lasts for retirement saving (and where you will break in a short time)

America in Hawaii has a minimum disposable income for only $ 2,797, and also landed at lower locations in Mississippi, Idaho, South Carolina, Nevada and Montana, with an average of $ 4,411 to $ 9,489. All other states saw disposable income a hit or more than $ 10,000.

See full disposable income breakdown of Cashnetusa by the state below:

Image Credit: Courtesy of Cashnetusa

Image Credit: Courtesy of Cashnetusa

A third Americans (33%) say they cannot even cover the bill for a month if they lose their income, and 47% recently refer to the cost of living as their biggest obstacle to save, according to recent survey From Yahoo Finance and Marist Pol.

Each state’s living wages are at least $ 82,000 per year, and in 26 states, a family of four will have to earn at least $ 100,000 annually, which should be considered “financially safe” – or $ 150,000 if they are in Hawaii, Massachusets, California and New York, according to per Gobanking. data,

Related: People under 25 years of age have the best chance to make money in this American state – and these 2 are the worst among others.

The rest of this article is closed.

Join the entrepreneur, To reach today.