It is a section of the Empire Newsletter. To read full versions, subscribe.

Since Crypto continues to shift to a more fundamental focus, it makes sense that the new matrix will be introduced – such as Net New Assets (NNAS).

Blockworks research Defines them As “the property which was not present earlier and/or could not be present without the crypto rail.” And, to be fair, it’s not New According to my colleague Ryan Connor, metric to track.

Connor gave a report on NNAS and how he plays in the rise of consumer crypto, something in which I am interested.

Originally, Conner makes the case that Crypto is becoming more mainstream and rolling the red carpet for the consumer app. Now they have the opportunity to build their user’s bases and hope, will become profitable. UXS has improved, SEC is no longer out to achieve the US-based crypto projects, and Memcoin has found a niche.

There are three examples for Connor: pump (dot) fun, time (dot) fun and trust. Pump (dot) fun is probably the most obvious, for all the Go-to Memcoin Hub. For reference, the chart below shows the launched tokens.

“Importiously, the pump (dot) did not do anything new. It only addresses the latent demand. For years, Crypto natives have bent backwards to release arbitrary property with fun names, trade them and find the next 1000x,” Carner wrote. Pump (dot) fun just took advantage of the story.

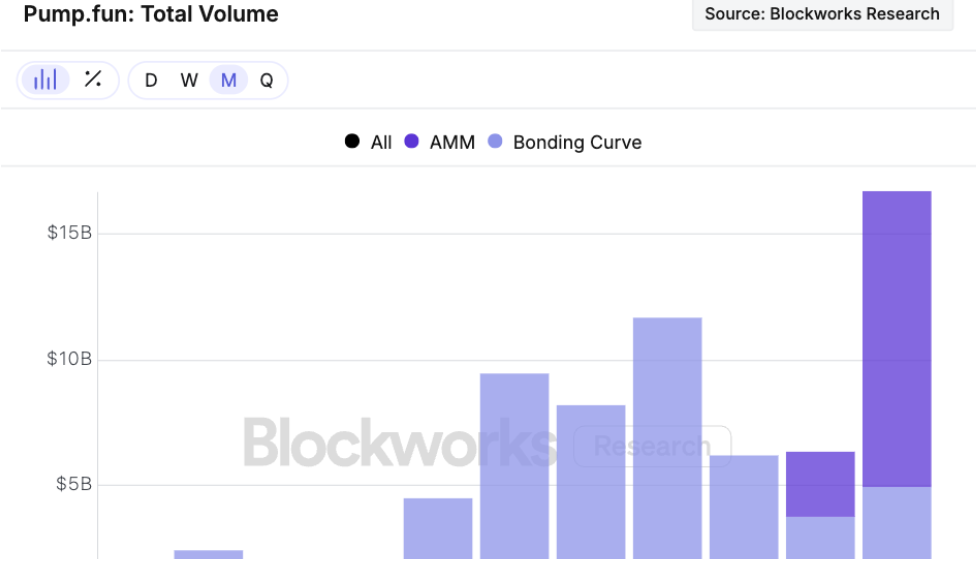

I mean, just take a look at the total amount of pump (dot) fun.

But the impact only moves beyond the forum, connor told me. This has also increased in overall memecoin.

“A handful of Crypto country funds are telling us that they believe that there is power in pump (dot) fun style Memcoin Trading. We feel that the market is starting to wake up for this reality, because the builders are bending hard in the category,” he wrote.

Stretched from similar roots, blockworks research feels that social tokens also have their own living power … but they will need to be maintained in any way. Time (DOT) Fun demanded to resolve the issue when the creators allow both trading fees to earn or purchase, and allow them to earn fees on volume and reduce minutes by fans.

For non-crypto comparison, think Camio Playbook.

But time and believe that each has a way to go to prove that they can maintain pump (dot) fun level traction.

Apparently, I have held many discussions with confidence in Connor and initially, I was lukewarm for it. But they have a compelling case. And chart Does Speak for yourself

Vishwas is different from either pump (dot) fun or time (dot) fun, in which it wants to give traders and developers access to a market where both can interact directly. The target picture is to remove the enterprise capital and allow traders to invest in small projects with the aim of creating an app.

“A few million dollars of free cash flow possible equity assessment will be low, but suppose, the best case, can be valuable on 20m USD through further (free cash flow), as well as some premiums for development through a large installed base of a few (hundred) thousand or million downloads,” the Conner explained.

“While this is a great result for the founder, this result is too small for a VC portfolio. By targeting this undested corort on the supply side, it is believed that retail Crypto brings upside down like an enterprise for the growing corket of Capital,” he said.

If successful, a market opens for Crypto, providing the same trades to private companies such as SpaceX. Undoubtedly, there is a demand, but how long?

Even with a record of pump (dot), you can see in the chart that it has happened many times when activity has been submerged due to loss of appetite.

However, the data is difficult to deny, and for now it looks like these three, not only acts in a way to achieve retail investors in the door, but also keeps them active in space.

Get news in your inbox. Explore blockwork newsletters: