Bitcoin (BTC)

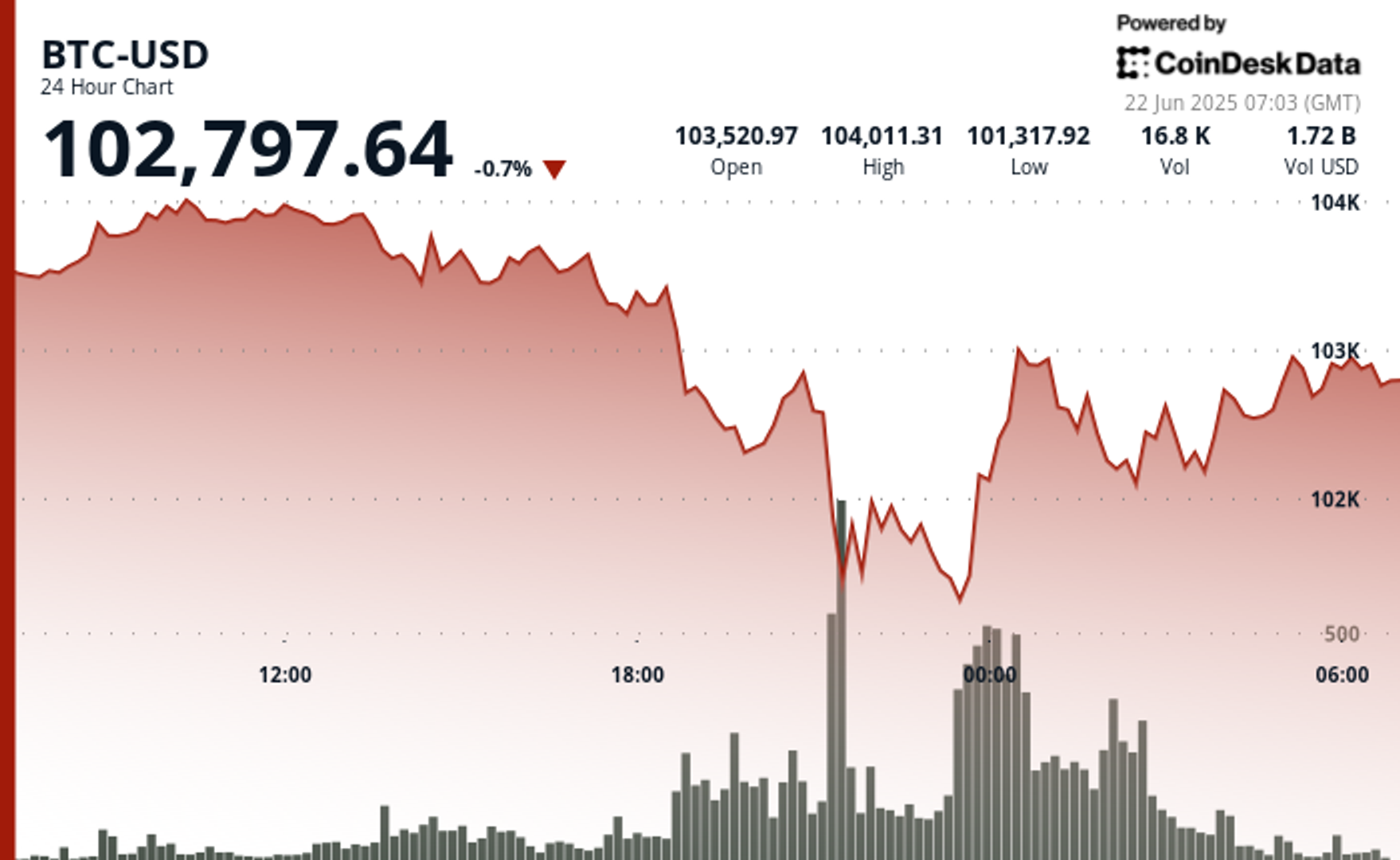

According to the technical analysis model of Coindesk Research, rallies above $ 102,000 after falling down $ 101,000 in an unstable session marked by unusually heavy trade.

The market participants reacted rapidly to the dip, which pushed BTC under their long trading range of the month.

Reversal gained momentum as a volume, leading to a strong rebound. This step was a coincidence with a sharp word post from James Lavish, a managing partner of bitcoin opportunity fund, which, which X written on x, “If you are selling bitcoins due to the possibility of going to the world to war, you don’t know what you are.”

The $ 100K-$ 110K range includes price movement for about a month. On-chain matrix suggests a balanced market with neither excessive advantage nor aggressive accumulation, while derivative data indicates cautious feelings with continuous demand for negative security.

Technical analysis highlights

- A midnight push picked up BTC above $ 102,800 with trading volume peaking at 17,906 BTC.

- Between 05:57 and 06:00, BTC climbed from $ 102,767 to $ 102,912, supported by spikes more than 150 BTC per minute.

- The volume of the peak recovery-term hit 184.24 BTC, leading to the price of the drive to $ 102,990.

- The minute-level consolidation occurred before a breakout of $ 102,680- $ 102,720.

- A high support level with a decrease in instability began to be formed near $ 102,870.

Disclaimer: Some parts of this article were generated with assistance from the AI tool and reviewed by our editorial team to ensure accuracy and adherence. Our standard. See for more information Coindesk’s full AI policy.