This is a segment from the forward guidance newsletter. To read full versions, subscribe.

Economic data is ending.

After an artificial bounce in economic data due to tariff front-ringing, the underlying economic data has started rolling. what comes next?

A few months ago on the forward guidance roundup, we discussed the idea of an economic “Mirage”, which is operated by the front-wake of upcoming tariffs.

The argument went in this way:

Since the threat of tariff was in danger for so long before they were live, the companies were able to import the same goods as they could before.

Because of this, pure exports become pit, as that metric is calculated as imports – exports, which leads to mechanically GDP calculations. This is why we saw a very negative GDP print in the last quarter despite the real economy. Mostly Good.

This also led to a large acceleration in business balance:

Since the companies had carried forward all their imports, it was dynamic reversal, where the import was minimized after the tariff was actually implemented.

This led to a big positive upset in GDP:

Mechanic, in the second direction, it has reversed through the economy and caused a strong bounce in soft data:

Now we are starting to see the initial signals that this mechanical bounce in development is beginning to decrease.

In the labor market, although the topline data such as unemployment rate has not increased, major labor indicators are continuing their march higher:

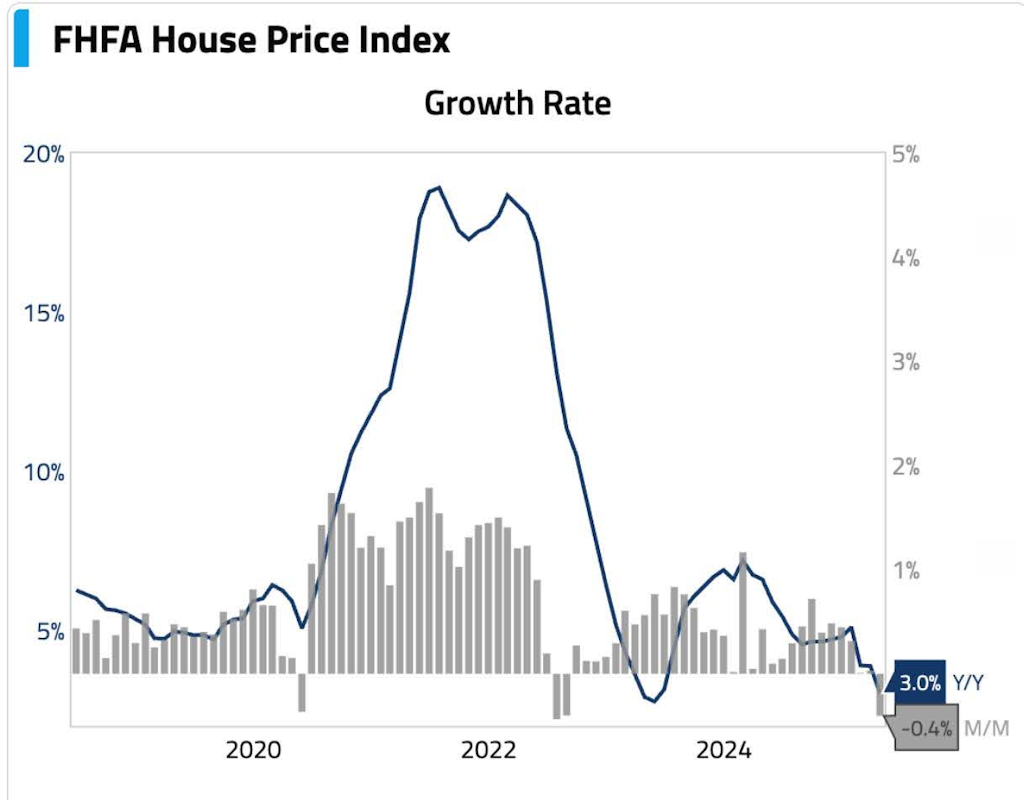

In addition, it seems that the housing market has started deteriorating after being frozen for the previous year:

Overall, with the FOMC, it is committed to delay to restart the rate cuts as much as possible, risks are increasing.

Get news in your inbox. Explore blockwork newsletters: