The price of the indigenous token link (link) of the Oracle provider Chanlink climbs 4% on Monday to expand its rebound from the end of the previous week’s crypto carnez.

Tokens hit $ 17 during the session, about 10%from weekend climb, coindesk data show.

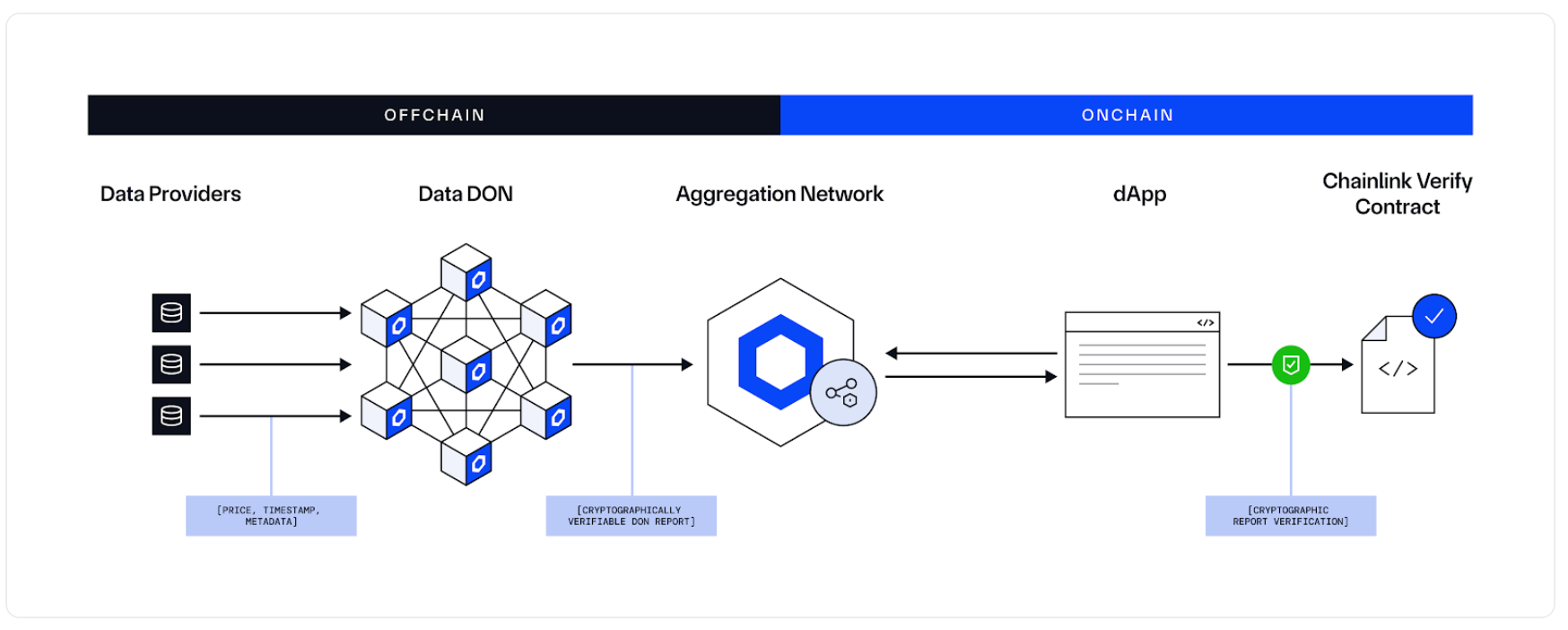

This step took place as a chainlink roll Market data feed for American equity and ETFs, to connect traditional financial equipment with on-chanting capital markets. According to the Chanlink Data Stream now, SPY, QQ, NVDA, AAPL, MSFT, and other equipment offer “real-time, high-thruput pricing” for assets such as other equipment. This feature enables using cases such as token stock trading, always futures and synthetic ETFs on blockchain rail.

The Solana-based DEFI protocol Comino and decentralized perpetuals trading site GMX has already started using the service, according to the post.

Johan Eid, Chief Business Officer of Chanlink Labs, said, “This is a significant leap for the token markets – closing a significant difference between traditional finance and blockchain infrastructure.”

Technical analysis shows strong speed

According to the technical analysis model of Coindesk Research, the link performed a significant performance in a 24-hour trading session, climbing from $ 16.16 to $ 16.87 and made sufficient 4.39% profit.

The model stated that the rally indicates a continuous rapid market spirit with strong high climbs during the stages and constant constant upward speed, $ 17.00 psychological range during the rally stages.

Technical indicator

- The general support installed at $ 16.11 representing the initial session low during the 24-hour period.

- The high-vantage support during the midnight UTC surge with significant trading activity is $ 16.29.

- The main resistance was formed at $ 16.87 with strong volume and several test efforts.

- Volume spike for 1,533,754 units during 4 August 13:00 hours, three times the average volume.

- Confirmation of brakeout patterns changed the support level of installation of significant resistance from $ 16.65 to $ 16.83.

- The higher climbing pattern is maintained throughout the rally that indicates the speed of constant speed.

- Volume confirmation supports price action upwards during rally stages above 30,000 units.

Disclaimer: Some parts of this article were generated with assistance from the AI tool and reviewed by our editorial team to ensure accuracy and adherence. Our standard. See for more information Coindesk’s full AI policy.