According to the Federal Trade Commission, Americans, aged 60 and above, lost $ 700 million for online scams in 2024, according to the Federal Trade Commission, marking the rapid growth in seniors targeting fraud.

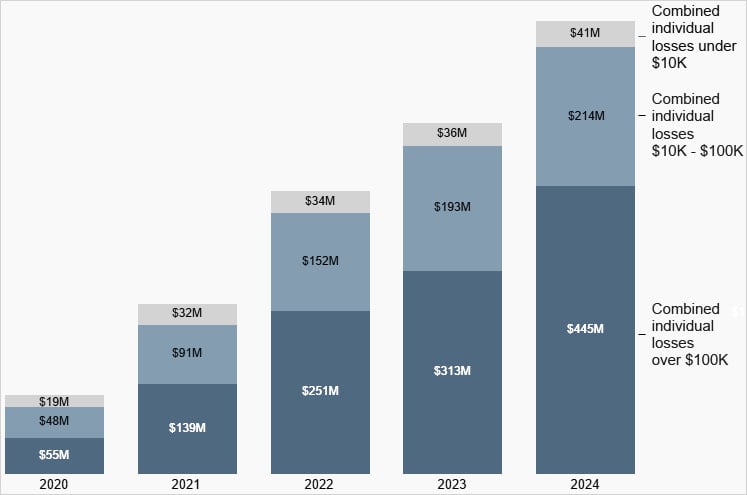

This figure was presented in the latest of the agency Consumer protection data informationRepresents an increase in all three categories of loss compared to previous years.

Most particularly, the amount of loss for those who lost more than $ 100k recorded eight times jump than 2020.

The zodiac signs below have been analyzed:

- Loss of above $ 100K: $ 445 million

- Damage between $ 10 and $ 100K: $ 214 million

- Damage under $ 10K: $ 41 million

In 2020, the total damage was $ 121m, so the 2024 figure of $ 700m represents six times the increase.

Compared to the previous year, 2023, where people above 60 were logged in loss $ 542m, 2024 represented a significant increase of about 30%.

Source: FTC

Prevalent scam strategy

The FTC Thrown light on 2024 involved the common scam strategy targeting old adults, including copying, fake crisis landscapes and phone calls.

The victims were told that their banking accounts were designed to create urgency, like suspected activity, their social security numbers involved in crimes, or hacks of their computers.

Scammers introduced the target with an alleged issue, including businesses such as FTC, or Microsoft and Amazon, to help the target.

According to FTC report, “In another layer of irony, these scammers often pretend to be FTC, the country’s consumer protection agency, which sometimes replicate real employees.”

“Reports show that these scammers have asked people to transfer money from their accounts, deposit cash in bitcoin ATMs, and even hand over the courier to cash or gold piles – everything that will never do real FTCs.”

FTC stated that most of these scams begin online, but often phone calls made to speed up the pressure are also made and the victims manipulate emotionally, while they are in a weak, isolated condition.

Older adults often become the goal of scammers due to large financial reserves, confidence or honor and poor understanding of technology.

FTC says that in many cases, they lose their entire life saving and even 401 (K) S, causing them to be economically and emotionally destroyed.

To be safe from these scams, the agency recommended never to learn money or share financial information with unknown collers or messengers. Instead, people should hang and verify the agency or company directly using publicly available contact information.

While there is no doubt in $ 445 million lost by people over 60 years of age in 2024, it is a significant amount, it was lost in 2024 in 2024 than the total amount, which was $ 12.5 billion, according to FTC.

It was a record amount, increased by 25% in 2023, since FTCs began to log the data, showing the continuous increase in damage to scams.