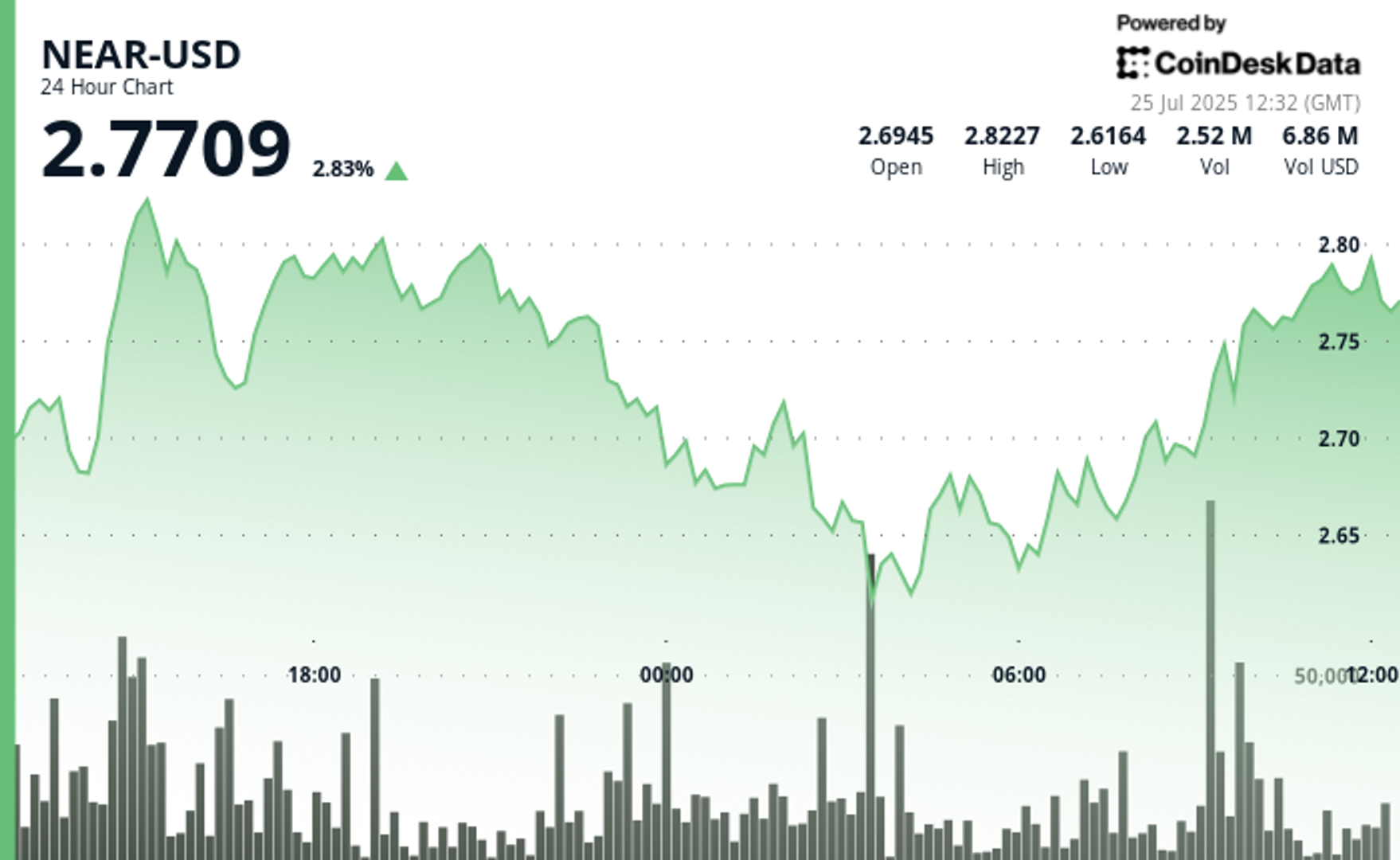

The near protocol on Thursday jumped 0.7% between 11:10 and 12:09 UTC, erasing a brief $ 2.77 dip in a unstable trading window marked by sudden institutional flow. The token went from $ 2.79 to $ 2.77 before recovering the height of the session, exposing a two-step move characterized by $ 2.78, followed by a celloff and Swift recovery.

The rebound was triggered by a sharp upper in the volume, with more than 123,000 units trading after 12:01, breaking through resistance levels and indicating potential accumulation by large players. The move capted a comprehensive 6.9% rally with the support of $ 2.61 with support of $ 2.79 during the July 24–25 trading window, fuel with an increased instability and revived boom.

Analysts look at the Serge as a potential setup for $ 2.83 resistance level testing, with long-term estimates in $ 1.95- $ 9.00 range for 2025 in the range and $ 71.78 by 2030 as high. The continuous development of cross-chain bridging with solana and tones is quoted as a catalyst for institutional interest and potential value expansion.

Technical breakout signal speed speed speed

- The $ 0.22 trading range represents 8.50% volatility between maximum and $ 2.61 minimum during a period of 23-hour.

- The strong $ 2.61 support level confirmation is more than 3.18 million daily average.

- Recovery Momentum $ 2.69 to $ 2.79 close target $ 2.83 success of the resistance field.

- $ 2.78 before consolidation $ 2.77 support testing fasting during mid -session instability.

- The extraordinary 123,000+ unit volume confirms the institutional accumulation phase during the last-hour growth.

- Several resistance levels during recovery install broken new $ 2.79 session higher.

Disclaimer: Some parts of this article were generated with assistance from the AI tool and reviewed by our editorial team to ensure accuracy and adherence. Our standard. See for more information Coindesk’s full AI policy.