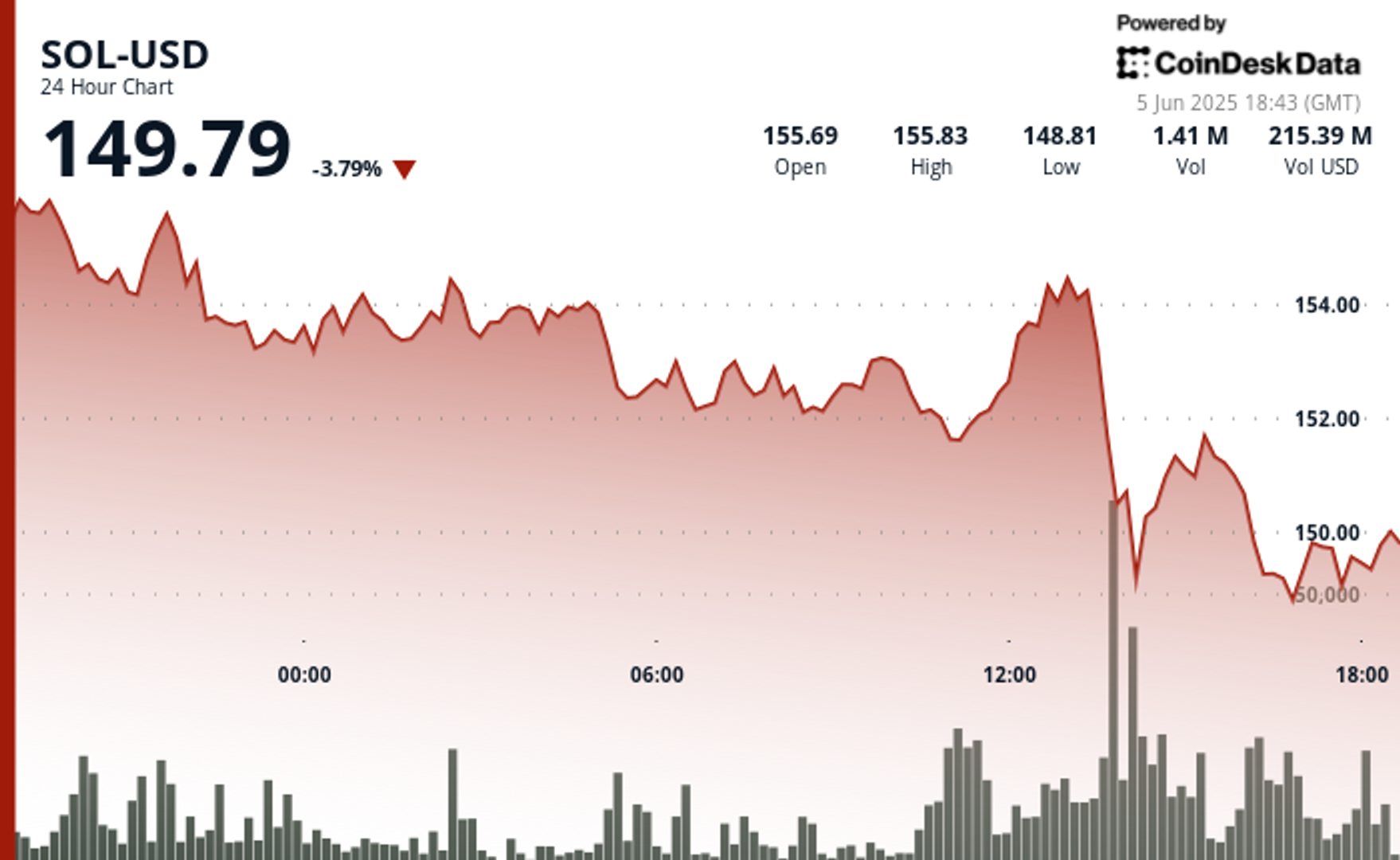

Solana (Sol) continues to face the pressure of increasing recession as the psychologist slipped the price below the $ 150 level, marking the decline of 5.2% in the last 24 hours.

Sales intensified during the early afternoon session with flood exchange with high-vantage trades. Analysts have been transferred over 3 million soul tokens to centralized platforms over the last three days, coinciding with more than $ 468 million in an estimated outflow.

This significant change in on-chain activity has raised doubts over the possibilities of short-term recovery, even the Solan Network continues to post strong use matrix.

With more than 100 million transactions and 7 million daily active addresses, fundamentals suggest long -term power, but the price action protocol is different from performance.

Analysts say it is now important to retrieve resistance at $ 153 and stabilize above $ 150 is now important to prevent a deep retracement.

Technical analysis highlights

- Sol-USD posted a range of $ 8.19 at a low of $ 149.79 from a high level of $ 157.98.

- Price violated psychological support at $ 150 during a large scale 182k volume spike at 13:56.

- Resistance remained firm at $ 153.00 due to repeated recovery failure during the late session.

- A descending channel has developed with a lower high and lower climbing dominating the chart.

- Volume grows at 13:39 (21k), 13:45 (66k), 13:51 (89k), and at 13:56 (182K), confirming the aggressive sales.

- The slight purchase interest is emerging around $ 149.50- $ 150.60, but if the bulls cannot catch the current floor then the risk remains.

Disclaimer: Some parts of this article were generated with assistance from the AI tool and reviewed by our editorial team to ensure accuracy and adherence. Our standard. See for more information Coindesk’s full AI policy.