Solana (soul) remains under pressure because macroeconomic headwinds – especially renewed tariff concerns – rattle investor trust.

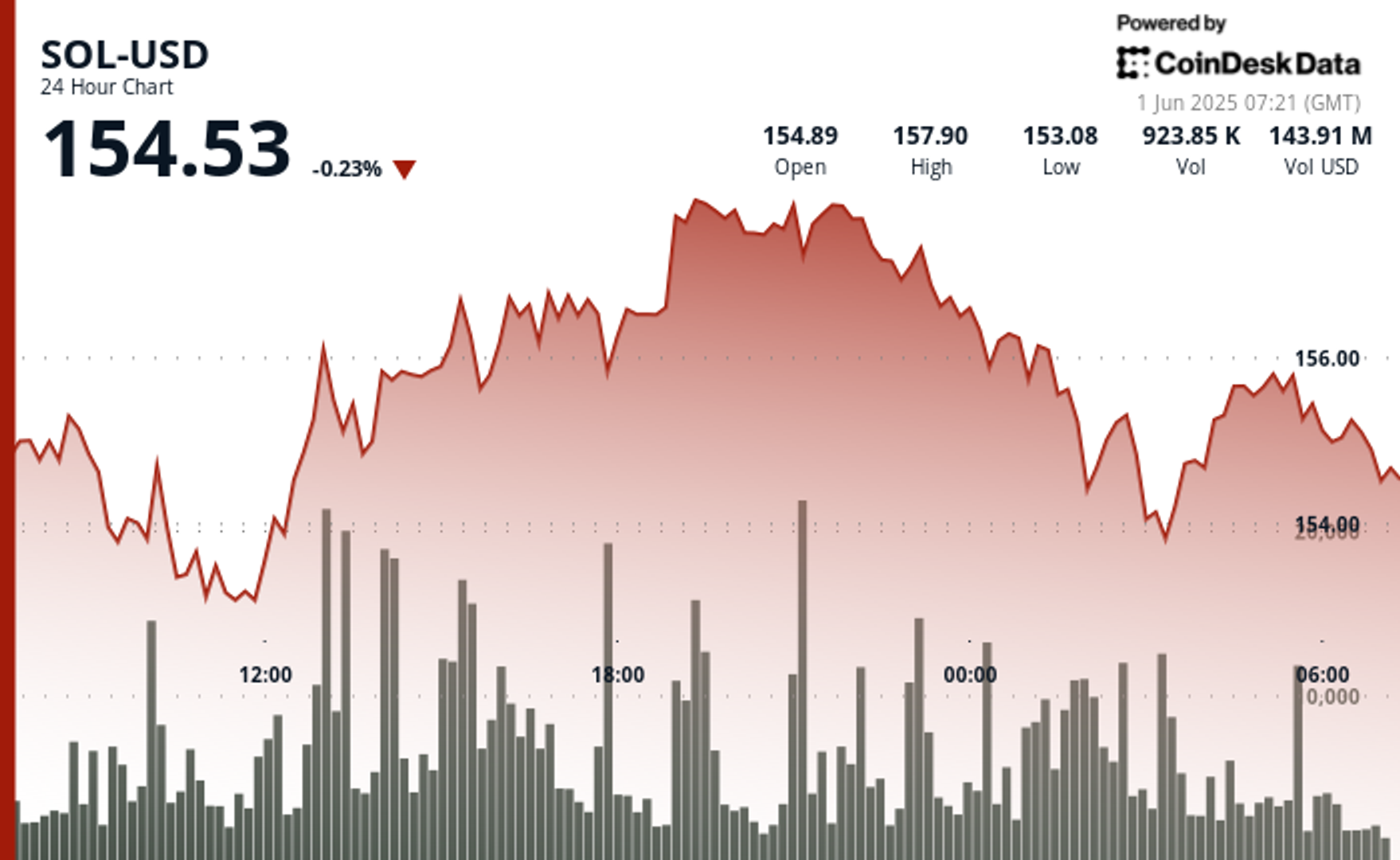

According to the technical analysis data model of Coindsk Research, the token is now hovering around $ 154.50 after setting up a tight trading range between $ 152.33 and $ 158.06, reflecting the 3.76% swing in the last 24 hours.

Although high climb suggested flexibility earlier, Sol slipped from $ 156.74 to $ 154.86 in the same hour, broke under its mid -April uptrend channel.

Derivatives reflects the spirit of data recession: the open interest in Sol futures is $ 2.47% to $ 7.19 billion, while long liquidity has increased, which increased to $ 30.97 million, indicating pressure on leveraged positions. Strengthening negative prejudice, short liquidation remains minimal.

Nevertheless, institutional interests are clear. Circle’s recent $ 250 million USDC Mint has added liquidity on Solana and 34% of the series stabeloin volume is now routed through the network. Additionally, the signs of the $ 1 billion verification fund of SOL strategies maintained long -term belief in the scalability of the protocol, even the short -term value action staggering.

Technical analysis highlights

- Sol established a 5.73-point range ($ 152.33- $ 158.06), indicating 3.76% intraday swing.

- Earlier, the price action detected a clear ascending channel with concrete support near $ 152.80, supported by heavy accumulation. Sol hit a strong volume at the $ 158.06 session during 19:00 hours, indicating the first rapidly.

- In the morning hours, a reversal, Soul increased from $ 156.74 to $ 154.86. 01: 53–01: reached the peak between 54. More than 74,000 units traded in a rapid burst.

- The short -term speed turned to the recession in the form of lower height and weak volume, which defines the final trading stretch. As a writing, Soul is integrating near $ 154.50, suggests the price stability, but with negative risk if the volume does not improve.

External reference