This is a segment from the forward guidance newsletter. To read full versions, subscribe.

I am quite old to remember that, a few months ago, the Trump administration talked about a loss of up to 3% of GDP.

However, since the Liberation Day Pivot, the Trump administration has 180’D on its goals and now has a new way to manage the American debt position: heat it.

Often, a moment zeitgeist can be easily encountered by a meme:

Last week, Treasury Secretary Scott Besent indicated on this axis in a CNN interview:

“There is a possible increase in debt, but what is more important that we increase the economy rapidly. I have inherited a decrease of 6.7% as a percentage of GDP, and we are trying to bring GDP faster than a loan by reducing spending, increasing revenue and (growing).”

Read on the lines of the quotation of Bessent and you feel implications for the owners of American Treasury.

Luke Goman said this best:

This is financial suppression in action: increase the path of getting out of a high loan/GDP ratio by making bonds lower than the growth rate of the economy.

For example, if the yield of bonds is fixed at 4%, but the economy grows at 6%, you can fix the debt as the yield is fixed and will be reduced by the burden over time as high revenue makes it less cumbersome.

I sympathize with the idea expressed during the interview: the White House wants to cut spending and increase revenue. However, while square the idea with house tax and spending bills, just passed through the night – it does not pass the smelling examination.

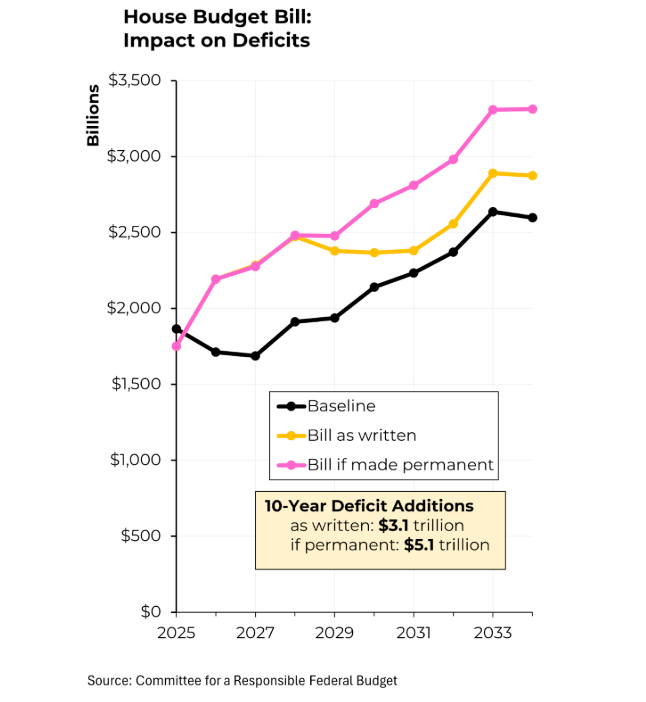

The new bill will reduce the deficit of about $ 3 trillion in the next 10 years:

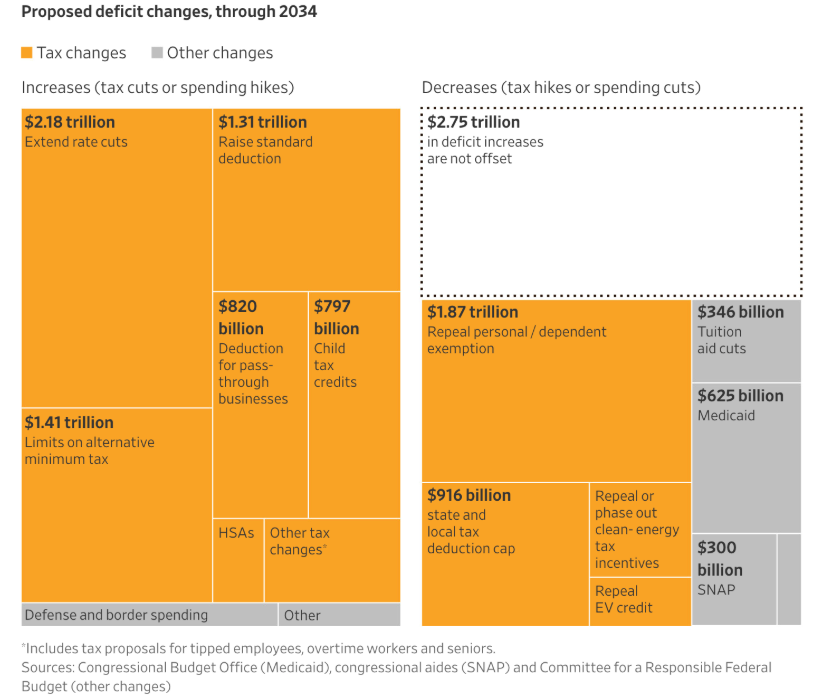

Breaking calculus, a significant amount of bill expenses will have to be funded by issuing high loans:

To play the role of Devils Advocate, the scoring and measurement of this bill is filled with discrepancies that must be accepted:

- It is not responsible for increasing tariff revenue to partially offset this bill. An effective tariff rate of 15%, which almost where things are standing today, will bring $ 300- $ 400 billion in a year. This will help partially to partially offset the wide deficit, but not completely, and this revenue would definitely not be golden guilty that the Trump administration expected it to reduce the deficit for pre-biden levels.

- The scoring in the bill considers Trump’s quick termination of the first-period tax deduction that later reinstated, which despite being pure-stagnant led to a superficial increase in tax cuts.

On the one hand the semantics, it is clear that the policy goal has shifted from a penance (remember Dogi?) In one of the economy that is hot to reduce the debt growth of the economy.

This strategy is not new. In fact, it is in line with the US government’s approach since 2021.

In the great words of Lynn Alden: Nothing stops this train.

Get news in your inbox. Explore blockwork newsletters: