Global economic stresses are heavy weights on cryptocurrency markets because XRP experiences a significant improvement amid heavy sales pressure.

The recent announcement of a potential 50% tariff on the import of the European Union by the US government has triggered the uncertainty of the wider market, despite recently reaching the new all-time high with the XRP, the most prominent cryptocurrency as well as the biggest cryptocurrency has declined.

Technical analysts indicate significant support in $ 2.25- $ 2.26 range, the market watchs that a break below this level can trigger deep improvement towards $ 1.55- $ 1.90 zone.

Meanwhile, an XRP futures with shares of institutional interest volatility remain strong to launch ETF and increase the leverage eTF inflowsing despite the fall in the price, suggesting that the deposited position continues during the weakness of the Wall Street Market.

Technical analysis highlights

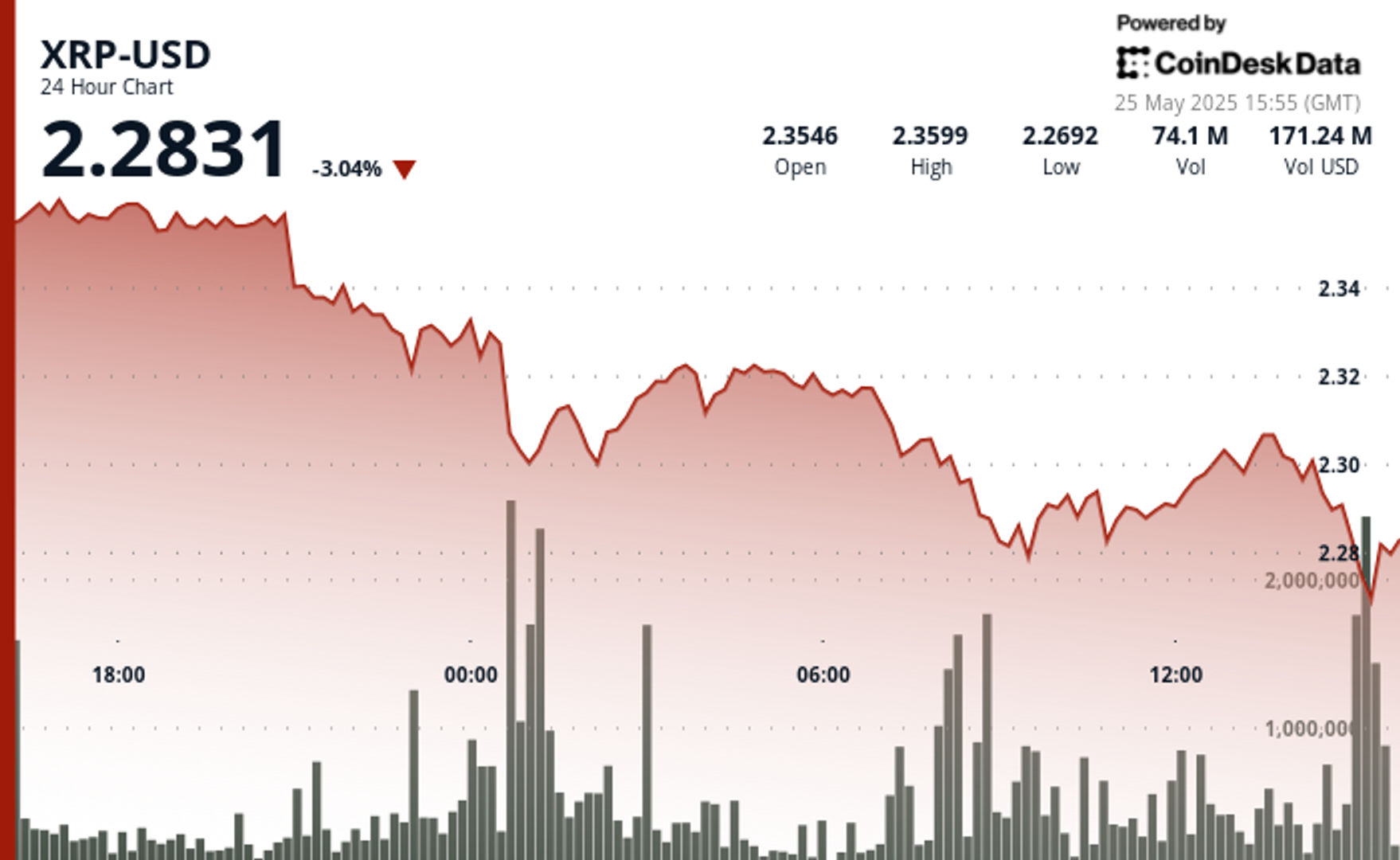

- The XRP improved a notable 3.46% in a 24-hour period, decreasing from $ 2.361 to $ 2.303, leading to a overall range of $ 0.084 (3.57%).

- The most important price action occurred during midnight hours (00:00), when XRP fell exceptionally to $ 2.297 at high volume (37.1m), establishing a strong volume-based support area.

- At 08:00, a secondary sales noticed that the value reduces the duration of $ 2.280 with the highest volume spike (39.9m), confirming a double-bottom formation.

- In the last hour, the XRP experienced significant instability with a recovery attempt after the first improvement.

- After reaching a low of $ 2.297 at 13:11, the price created a base around $ 2.298 before staging an enough rally starting from 13:27, which with an extraordinary high volume (627k-480k) at $ 2.298, which is extraordinary at $ 2.307 at 13: 36-13: 39).

- The speed of this speed created a clear resistance area at $ 2.307, which was tested several times.

- The pressure to take advantage in the final 15 minutes revealed, which reached $ 2.300, a short -term support level installation that psychologists align with $ 2.30 threshold.

External reference