This is a segment from the supply shock newsletter. To read full versions, subscribe.

“The scenario of bitcoin going to zero is no longer present. BTC is playing a very role as Gold did in the early days of banking.”

You are probably beyond the exact post on X, which was shared by a scambot as an answer-wise-inspiration that inspires some fraud as an analyst.

Nevertheless, this is true. Bitcoin zero landscape does not really exist.

Obviously, I do not need to explain to you about that. But it was not always like this. The bitcoin was actually gone to the zero on this day, 14 years ago, perfectly localized on Mount Goks, of course.

Stacked against the swaths of scams that plagued Mount Gox, this special incident seems small, defeated with only 2,000 BTCs (less than $ 30,000 at that time).

The importance was in the spectacle. Practically all bitcoin trading Volume Before the mid -2011, Mount Gaux occurred, making it another only place for discovery of bitcoin value.

Bitcoin started more than $ 26 in the first two weeks of June-one all-time high that would be close to two years. Prices were now on their way, but at least one YouTuber saw that they were right very quickly.

“You are watching an accident in real time. We are below 4.8 (dollars), 4.6, 4.5, 4.4. I have been looking at it since about 17. I have not seen a single upper in this market. It is going straight down. I will be fascinated to know that I am sure we are going to get out. commented out On the value feed of Mount Gox.

“Well, I am all broken about my $ 99. The main thing is that I am broken, I can have 33 bitcoins ($ 560 then, $ 3.5 million now). So we are going to see how low this is.”

Within three minutes, the price of bitcoin on the exchange was flat at $ 0.01, with not a single positive tick on the below.

Bitcoinchannel was correct: there were some reports about Mount Goks. It was hacked.

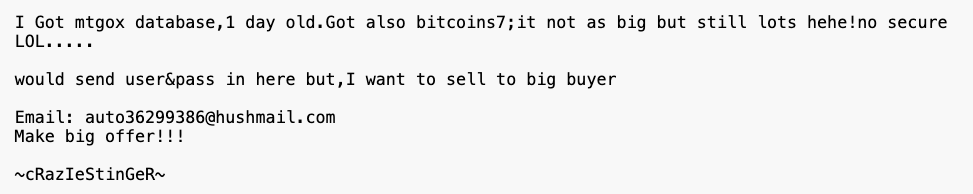

Two days ago, a pseudo -name hacker under ~ craziestinger ~ presented for sale for sale for sale for sale. EsotericThe next day, the then new owner Mark Carpellas Wags User accounts increased theft from accounts, but the victims appeared to blame themselves.

“So far I have 10 known cases of people whose coins were stolen (someone used their passwords to account for account, did USD business for BTC, all took back BTC). Given that we now have more than 60000 accounts (2 months ago we had 10 times less), it seems to be a problem coming from users mainly.”

Pastbin who sent bitcoin to zero

Pastbin who sent bitcoin to zero

As it turned out, ~ craziestinger ~ may have told the truth. Prior to the accident, on an unknown user’s Insidepro Password Recovery Forum, “Georgeclony“Asked the stolen database to help crack the Hashed password.

Many haveh were weak and according to one, quickly skilled This time Incidents of simultaneous events by investor Mark Bewand. “Some users who discovered leaks have run passwords brute-forrs against the hash list and have easily broken hundreds of them. Unlike the previous claims from the owner of Mtgox, it indicates that many accounts were compromised for minimal days, if not before today’s attack.”

And given that before the database leaked online, Georgechloni knew about Hash, Bewand concluded that he was the same person who was about to send bitcoin spilling.

On June 19, 2011 at 5:15 pm, in exactly 36 seconds of UTC, the man gave several orders to sell hundreds of bitcoins at a time. Bewand reported that Mount Gox took 30 minutes to process those orders and was completely unanswered during that time, as reflected in the video of Bitcoinchanl.

Overall, the hacker traded more than $ 1.5 million out of a total daily amount of $ 1.8 million. They then appeared trying to buy bitcoin back on the way for higher profits, as other users withdrew the price of bitcoin to a few dollars.

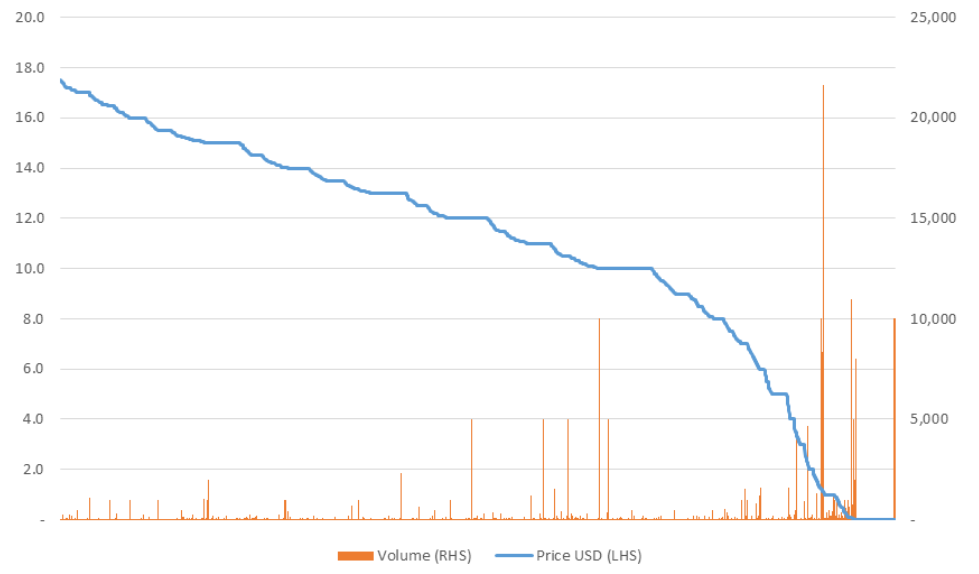

The price of bitcoin on Mount Goks during the accident (Source: Bitmex,

The price of bitcoin on Mount Goks during the accident (Source: Bitmex,

A user especially, “Kevin,” Claimed Bought 259,684 BTC for $ 3,000 (on average $ 0.016), but was able to withdraw only 643 BTCs, before Karpelus took offline to sort Mount Goks through dirt.

Finally, Mount Gox was rescued by the US dollar and bitcoin (which was unknown to the public until the latter). The internal, offcain order books of the platform at these boundaries were mostly damaged.

Curpelus opted to return the trading engine before starting its coordinated dump to the compromised accounts, a step that faced a dispute at the time. It is believed that about 900 accounts may be affected, and the stage will remain closed until August.

It may be that the hacker knew about the range of clearance, and chose to crashes the price of bitcoin, perhaps as part of a plot for siphon up to 100,000 BTC, if they were priced in $ 0.01 Apis, leading to a $ 1,000 cap.

“Or perhaps, as it happens sometimes, the attacker’s purpose simply causes havoc for entertainment (seems to have a script kidi doing random things). All the attackers are not like well-prepared robbers in 11 of the ocean, not with an accurate plan. It is probably the most simple explanation,” Baywand has written, “Bewand has written.

Get news in your inbox. Explore blockwork newsletters: