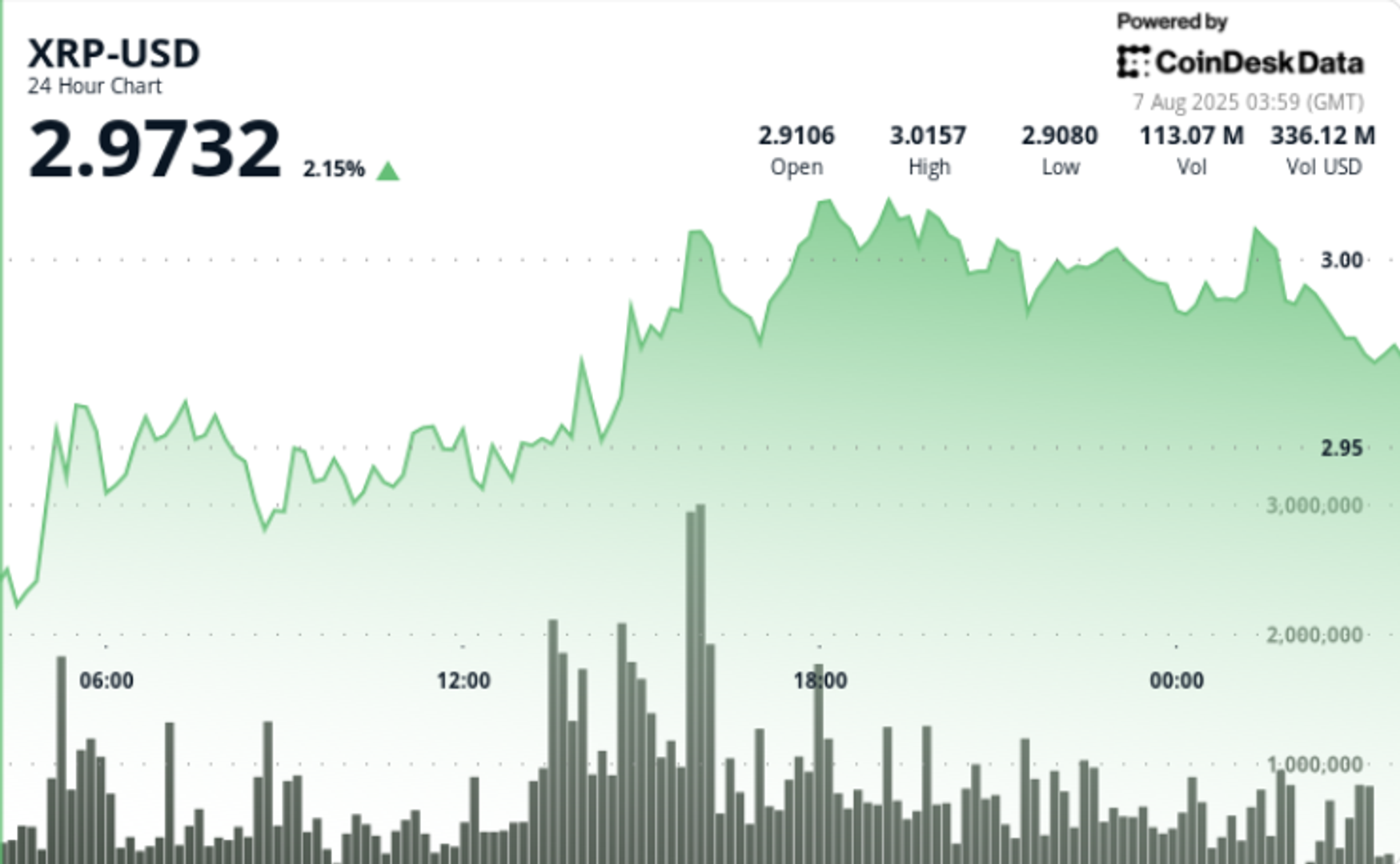

XRP rose 3% in 24 hours through August 7, increased from $ 2.91 to $ 2.98 to close to $ 2.98 before $ 2.98.

The step broke through several short-term resistance levels and coincided with high-trigger-buying activity, especially on the Korean exchanges.

The technical speed major aligns with macro development: the US Securities and Exchange Commission is set to consult Ripple’s appeal withdrawal, while SBI Holdings of Japan filed for Bitcoin-XRP ETF.

News background

The SEC is expected to deliberately lead Ripple’s decision to withdraw its appeal on 03:00 UTC on 7 August, which is ahead of the widespread decisions expected by the middle of the month. The hearing may be closed in non-protection position of XRP under the US law-a result that removes regulatory overhang for a long time.

Meanwhile, the ETF application of SBI Holdings exposed the international institutional interest, with efforts to diversify Treasury, there is a pledge of up to $ 1 billion in alleged XRP procurement to gain momentum from corporates.

Price action summary

- XRP traded within a 24-hour limit between $ 2.91 and $ 3.02, 3.7% bands.

- The strongest upward movement occurred between 15:00 and 16:00 UTC as the token increased from $ 2.95 to $ 3.02, buying more than 110 million tokens or more than three times the daily average.

- The flow of this flow originated from the upbit, which processed more than $ 95 million in XRP trades. The property was later consolidated between $ 2.98 and $ 3.00 in the session.

technical analysis

- The XRP broke through resistors at $ 2.87, $ 2.92 and $ 2.97 during the rally. The last hour showed an unsuccessful attempt to dissolve $ 3.02, with the volume to 2.11 million in the 10 -minute window.

- The level of $ 2.98 is now acting as short -term support. If bulls protect this zone, the reverse target remains at $ 3.05 and $ 3.14, ETF approval with $ 3.25 or SEC commentary must be favorable.

What are the traders watching

- SEC’s 03:00 UTC session and whether Ripol’s appeal withdrawal is formally given

- Follow from SBI’s ETF filing and potential flow

- The price reaction of $ 3.05 if XRP re -tested the local higher on upbit and binance volume trends as an indicator of retail and institutional engagement

- 15 August XRP regulatory comments before reviewing legal status