The XRP closed the Monday session under pressure, reversing an earlier rally and ended near the $ 3.00 threshold. A sharp sales in the final trading hour gave the asset a 1% dip on the increasing volume, suggesting institutional distribution and stop-loans liquidation driving price action.

Technical analysis shows mixed signal

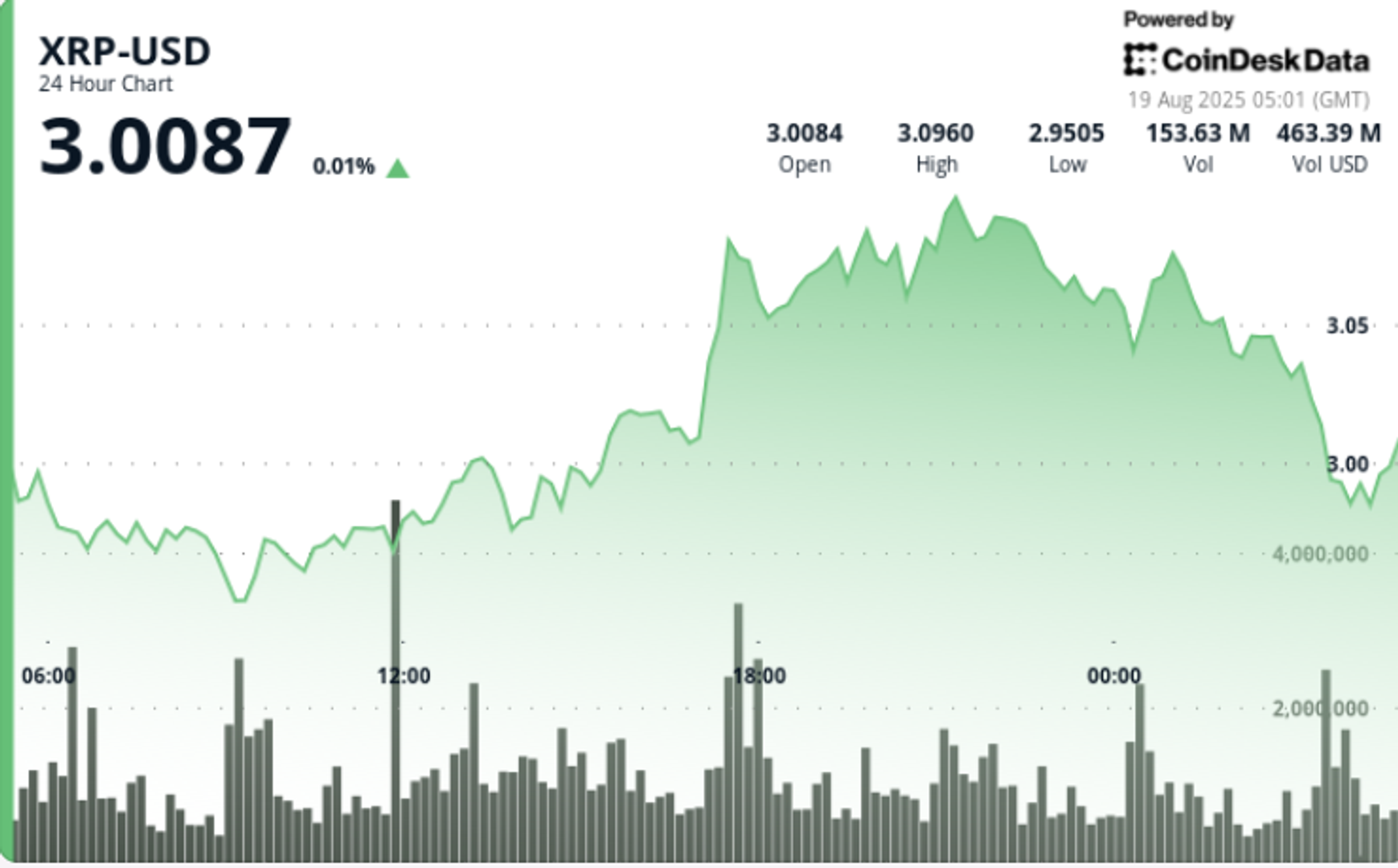

The XRP traded within the 24-hour season from $ 2.94 and $ 3.10 within the range of $ 2.94 and $ 0.11 from 18 August 05:00 to August 19 04:00, which represents about 4% intraday instability. On August 18, during the 17:00 trading hours, a rapid breakout pushed prices from $ 2.97 to $ 3.10, which is supported by huge amounts of 131 million-average an average of 66.8 million. It installed short -term support near $ 3.00.

Momentum faded quickly. Tokens rejected several times at $ 3.09, slipping around $ 2.99 in consolidation. On August 19, an aggressive pullback emerged during 03:00 hours, when XRP fell from $ 3.04 to $ 2.99.

Major market movement

• XRP recorded a decline of 1% in the final 60 minutes, with slipping from $ 3.03 to $ 2.99 -the volume 5.26 million -five times average average.

• Distribution pressure $ 3.00 was intensified around the psychological range, 03: 43–03: 46 Trigor

• First a rapid bounce in the session (18 August 17:00) removed the XRP from $ 2.97 to $ 3.10 to 131 million volumes, much above average activity

Market mobility drives sharply

Late-session breakdown confirmed institutional sales, which is near $ 3.00, which erases the speed of earlier breakouts. While $ 2.99 provides intraday stabilization, the volume-supported rejection at $ 3.09 highlights the increasing resistance pressure.

XRP now sits at an intersection: Keeping above $ 2.99 can allow the bull to resume $ 3.08- $ 3.09 cluster, while the failure risks a deep improvement towards the $ 2.96 demand area.

Technical indicator summary

• Range: $ 0.11 (3.8%) $ 3.10 peak and $ 2.94 trough

• Resistance: $ 3.09, repeatedly rejected through evening sessions

• Support: $ 3.00 psychological levels, tested under high-volume distribution

• Risk: Breakdown towards $ 2.99 demanding area if $ 2.99 fails

• Signal: Rapid triangle structure remains intact, but the speed disappears under the benefit.