what to know

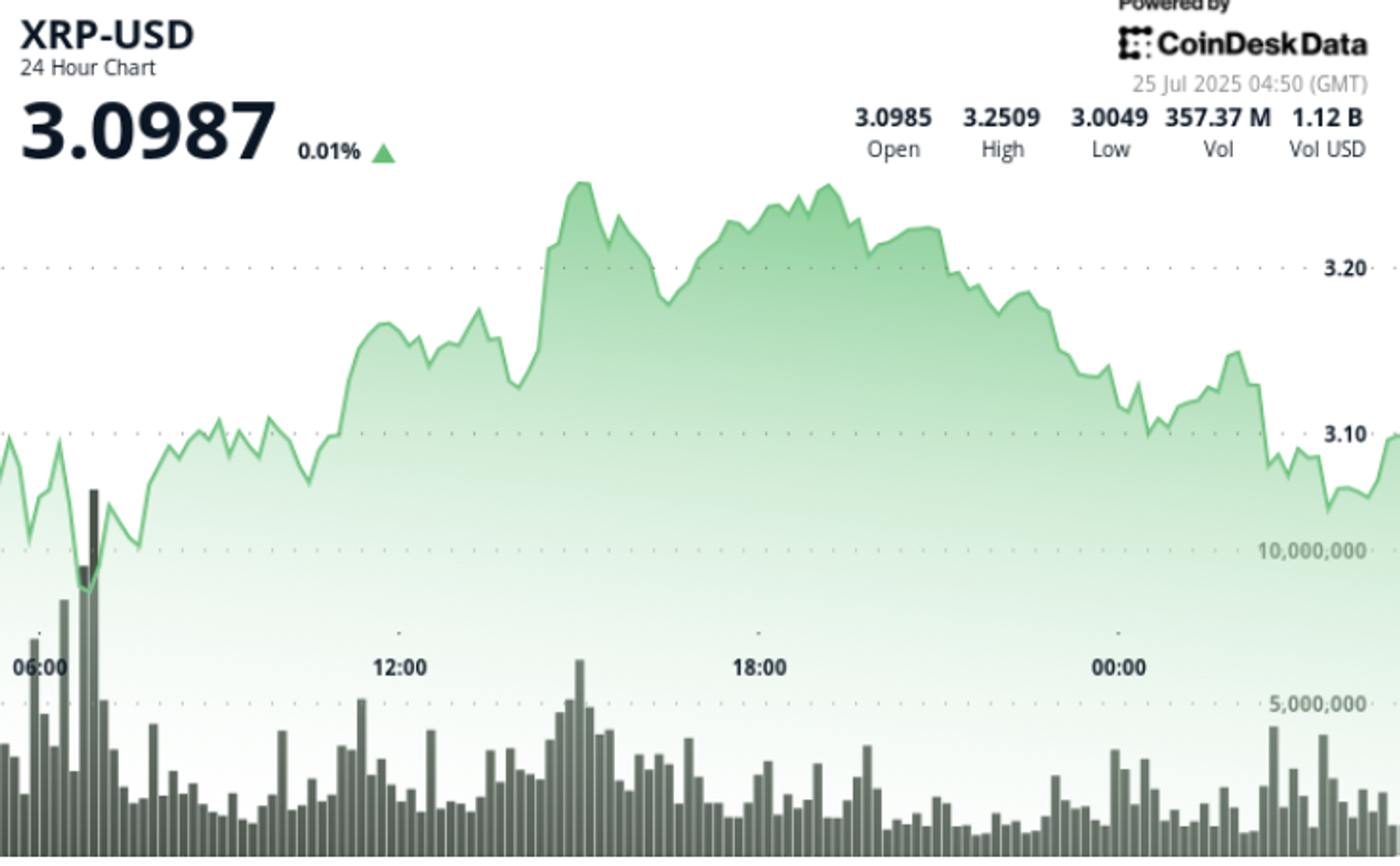

XRP posted a sharp loss during the July 24-25 season, traded 8% token from $ 2.96 to $ 3.26 in the token $ 0.30 range.

An initial session rally slipped after taking advantage of the resistance level, while a sudden liquid wave eliminated more than $ 100 million in a long position.

Regardless of the celloffs, the major support at $ 3.06- $ 3.10 conducted through repeated tests shows signs of potential stabilization with the price action of the late session.

Nature’s miracles and Brazil’s vert made headlines with new XRP-based strategies, but institutional vendors dominated the tape that the ETF approval could face a delay.

News background

• XRP traded in the range of 7.85% between July 24 to 05:00 to 24 hours between $ 2.96 and $ 3.26.

• Shown more than $ 18 billion in total crypto liquidity during the coaling data session.

• XRP tops the top of long liquidity at $ 105 million, contributing to a rapid decline.

• Nature’s miracle announced the $ 20 million XRP Treasury Scheme.

• Brazil -based vert deployed $ 130 million blockchain solution built on XRP laser.

Price action summary

Open the session $ 3.13 and saw a sharp fall by $ 2.96, followed by $ 3.26 at 15:00 high at 175.94 million volume – more than doubled by average. However, resistance at $ 3.24- $ 3.26 capted profit. The price session re -collapsed, 03: 00–04: 00 during window fell to $ 3.05 at 6.2 million volume spikes, possibly due to forced sales or liquidation flow. XRP recovered a minor recovery to shut down at $ 3.08.

technical analysis

• $ 2.96 low and $ 3.26 high $ 0.30 trading range.

• Confirmation of heavy resistance at $ 3.24- $ 3.26 after rejection post 15:00 rally.

• Frequent testing was done with important support volume-supported bounces at $ 3.06- $ 3.10.

• The final hour shows a breakdown by $ 3.05 before recurring $ 3.08 – a possible rapid indication.

• Liquidity-driven instability suggests that the risk has increased, but the firm bid areas provide short-term structure.

What are the traders watching

• Can XRP catch $ 3.06- $ 3.10 zone in the next session.

• ETF-related events beyond American regulators.

• Sign of institutional reunion or new retail participation above $ 3.15.

• Comprehensive crypto market stability after the liquidation of multi-aura-dollars.